Article from

Mandatory Information on an Invoice.

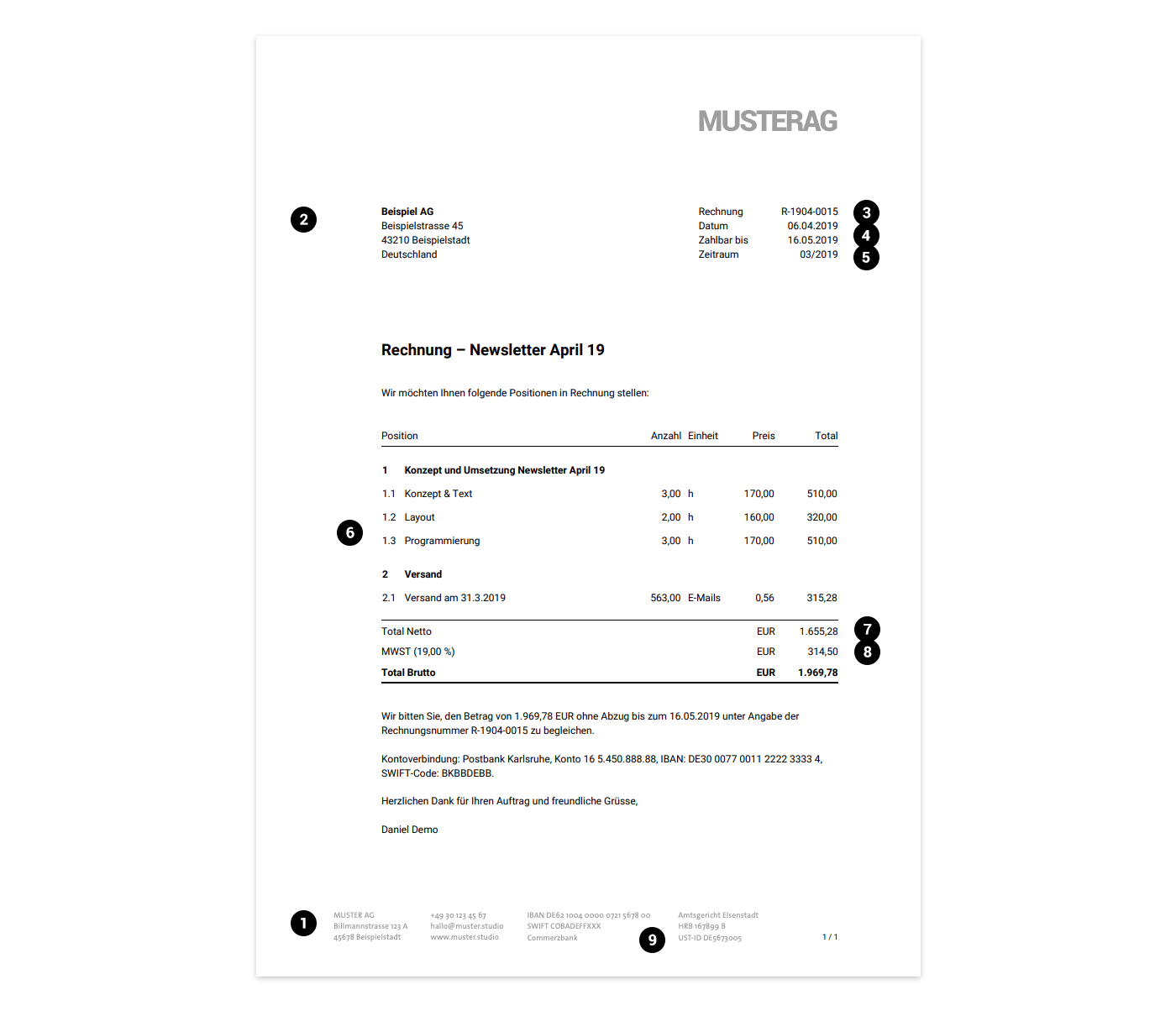

Incorrectly issued invoices can lead not only to reissues and payment delays, but there is also the risk that you cannot reclaim the input tax from the tax office. It is therefore important that all invoices sent and received comply with the following requirements.

English image not yet available...

English image not yet available...What belongs on an invoice

The following information must be found on the invoice of a service provider

1. Name and address of your own company

2. Name and address of the recipient

3. A uniquely assigned invoice number

4. Invoice date, payment deadline

3. A uniquely assigned invoice number

4. Invoice date, payment deadline

5. Date of service or period (calendar month is sufficient)

6. Type and scope of the service

7. Net amount

8. Tax rate and tax amount

9. Tax number or VAT identification number of the issuer

Additionally, these details are good to include on the invoice

Additionally, these details are good to include on the invoice

- A payment instruction

- For transfers, account details on the invoices

For example, part of the footer text.

Reverse Charge & Small Business Regulation

Additional considerations in the case of "Reverse Charge"

- Tax rate and tax amount: 0

- Reference sentence

The reverse charge procedure reverses the liability for VAT in cross-border deliveries: It is not the service provider who pays the VAT to the tax office, but the customer. A prerequisite for the application of the reverse charge procedure is that the customer also holds a VAT identification number (UID). A corresponding reference sentence on the invoice is crucial – e.g., in the footer text (e.g., "Liability for tax on the part of the service recipient").

Additional considerations in the case of the Small Business Regulation (Germany)

- Tax rate and tax amount: 0

- Reference to the small business regulation

If you fall under the small business regulation (especially sole proprietors, freelancers, or GbR) and apply it, you must not charge VAT on your invoices, as you would otherwise have to pay it to the tax office. Moreover, the following note should be included on the invoice: "According to § 19 para. 1 UStG, no VAT is included in the stated invoice amount."

Small business owners also need a tax number or VAT identification number, which they must indicate on their invoice.

Links to related topics

When project service providers issue invoices: Uniform VAT for main service and additional service.

Small business owners also need a tax number or VAT identification number, which they must indicate on their invoice.

Links to related topics

When project service providers issue invoices: Uniform VAT for main service and additional service.