Article from

E-Invoice, XRechnung, ZUGFeRD.

With XRechnung, the public administration in Germany has established a new standard for electronic invoices (eInvoices). This became necessary after the European Union, as part of its digital initiative, mandated all member states through Directive 2014/55/EU to ensure the receipt of electronic invoice data by public administrations across Europe. Here, we explain the differences between E-Invoice, XRechnung, and ZUGFeRD. MOCO generates the XRechnung format.

Digital Europe

Across Europe, the trend is towards digitalization. A significant driver of this development is the so-called “Digital Agenda for Europe 2020” – a program through which the European Union aims to prepare for digital competition on an international level.

The digital agenda focuses on improving consumer and business access to digital goods and services, creating the right conditions for the development of digital networks and innovative services, and better leveraging growth potentials within a digital economy.

The cost-saving potential of the eInvoice is expected to be enormous. Additionally, Italy, as a pioneer, hopes to achieve better control over rampant VAT fraud through associated real-time tax reporting.

The cost-saving potential of the eInvoice is expected to be enormous. Additionally, Italy, as a pioneer, hopes to achieve better control over rampant VAT fraud through associated real-time tax reporting.

The E-Invoice as Part of the Solution

The E-Invoice represents invoice contents – instead of on paper or in an image file like a PDF – in a structured, machine-readable XML dataset. This ensures that information issued in this form by the invoicer can be electronically transmitted, received, seamlessly processed, and automated for payment.

XRechnung & ZUGFeRD

The European standardization body (CEN) published the EU standard EN 16931-1:2017, which has been implemented in Germany as a “Core Invoice Usage Specification” (CIUS) – also known as XRechnung.

XRechnung Mandatory for Federal Clients in Germany

Since the end of 2020, invoices in Germany to federal clients exceeding 1000 EUR must be submitted digitally in the new eInvoice format XRechnung via the federal “Central Invoice Submission Platform” (ZRE). This can be done either directly or through a portal. Otherwise, they will be rejected and not paid.

Invoicers have various options for transmission methods. One of them is a PDF including structured data. For this purpose, the Forum for Electronic Invoicing Germany (FeRD) developed a common overarching format. This hybrid format is therefore called ZUGFeRD.

English image not yet available...

English image not yet available...Challenges for Municipalities, Public Enterprises, and Other Recipients at State and Municipal Levels

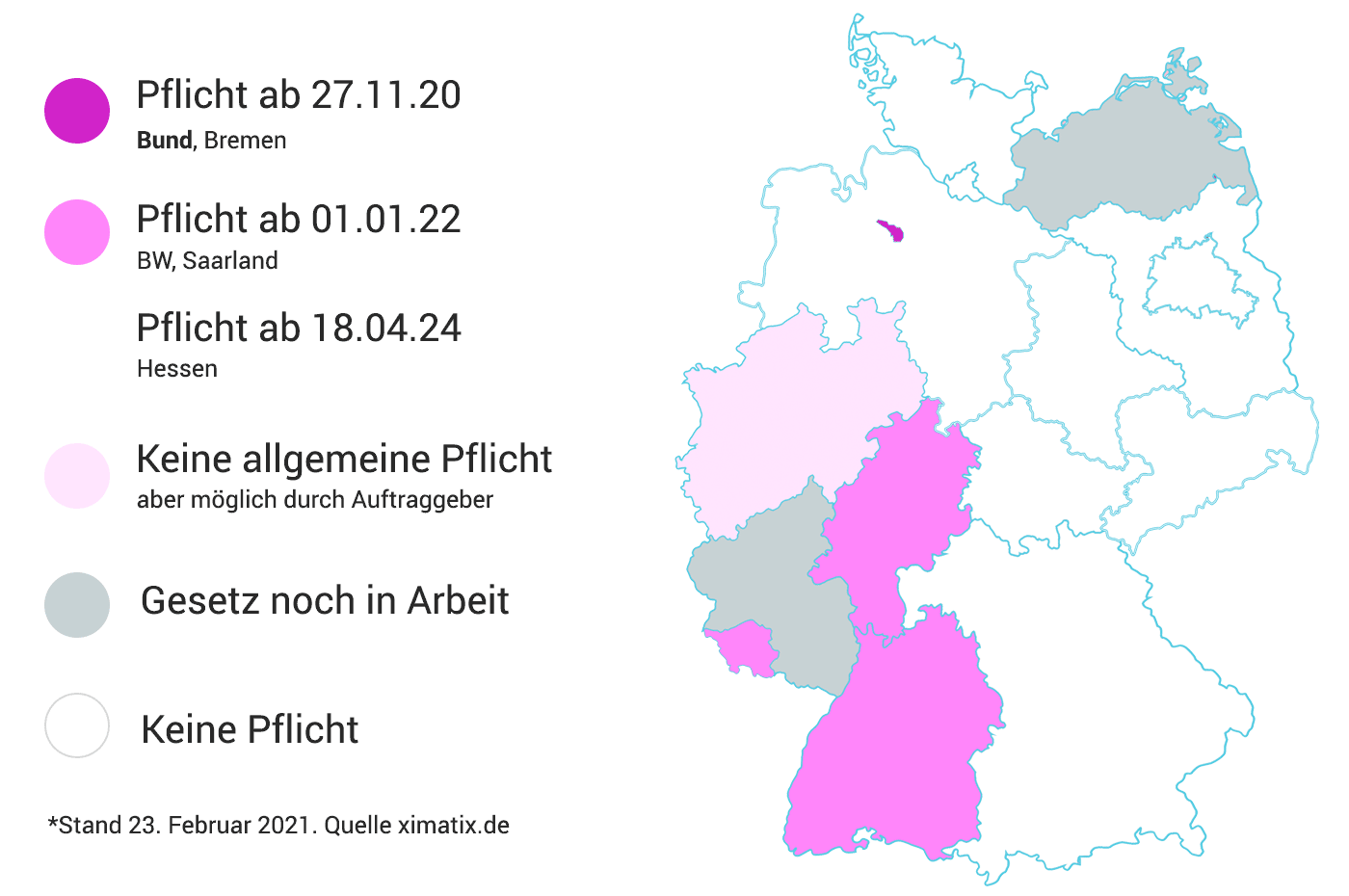

Regulations at the state level vary significantly

In practice, “uniform” electronic invoicing to clients in federal, state, and municipal administrations in Germany is far from “simple.” The increased activism of public administration was asynchronous. While the federal government has completed its “eInvoice” tasks, progress at the state and municipal levels is extremely varied – due to the federal nature of the system.

At the state level, there is (still) almost no obligation to send eInvoices to the administration. The sheer number of different detailed requirements, portals, transmission methods, and thresholds makes eInvoicing to public administrations and public enterprises very complicated. Especially when acting as a supplier or service provider to multiple invoice recipients in different states, municipalities, or regions.

Not only are there differences at the state and municipal levels, but there are also often numerous uncertainties within these areas.

Therefore, it must be clarified with each client individually how invoicing should be done and what information must be transmitted with the XRechnung. What is always needed is an identification number of the client – usually, this is the Leitweg-ID. Additionally, a supplier number and an order number may be required.

In practice, “uniform” electronic invoicing to clients in federal, state, and municipal administrations in Germany is far from “simple.” The increased activism of public administration was asynchronous. While the federal government has completed its “eInvoice” tasks, progress at the state and municipal levels is extremely varied – due to the federal nature of the system.

At the state level, there is (still) almost no obligation to send eInvoices to the administration. The sheer number of different detailed requirements, portals, transmission methods, and thresholds makes eInvoicing to public administrations and public enterprises very complicated. Especially when acting as a supplier or service provider to multiple invoice recipients in different states, municipalities, or regions.

Not only are there differences at the state and municipal levels, but there are also often numerous uncertainties within these areas.

Therefore, it must be clarified with each client individually how invoicing should be done and what information must be transmitted with the XRechnung. What is always needed is an identification number of the client – usually, this is the Leitweg-ID. Additionally, a supplier number and an order number may be required.