Alter News-Artikel!

» Hier geht's zur aktuellen Online-Hilfe

Article from

Tax codes for accounting.

MOCO is meant to be simple – yet still provide optimal data for accounting. That's why we continue to refine the transition step by step.

Tax rates on track

Most will have noticed – the previously free entry for the tax rate has been secretly replaced by a fixed selection. The selection of tax rates can be supplemented if needed – but for now only by us. So if you use special tax rates for certain reasons (e.g., as an Austrian account the temporary reduced tax rate of 5% for books), then just contact us via the service at the bottom right (or select "Contact Form" in the footer).

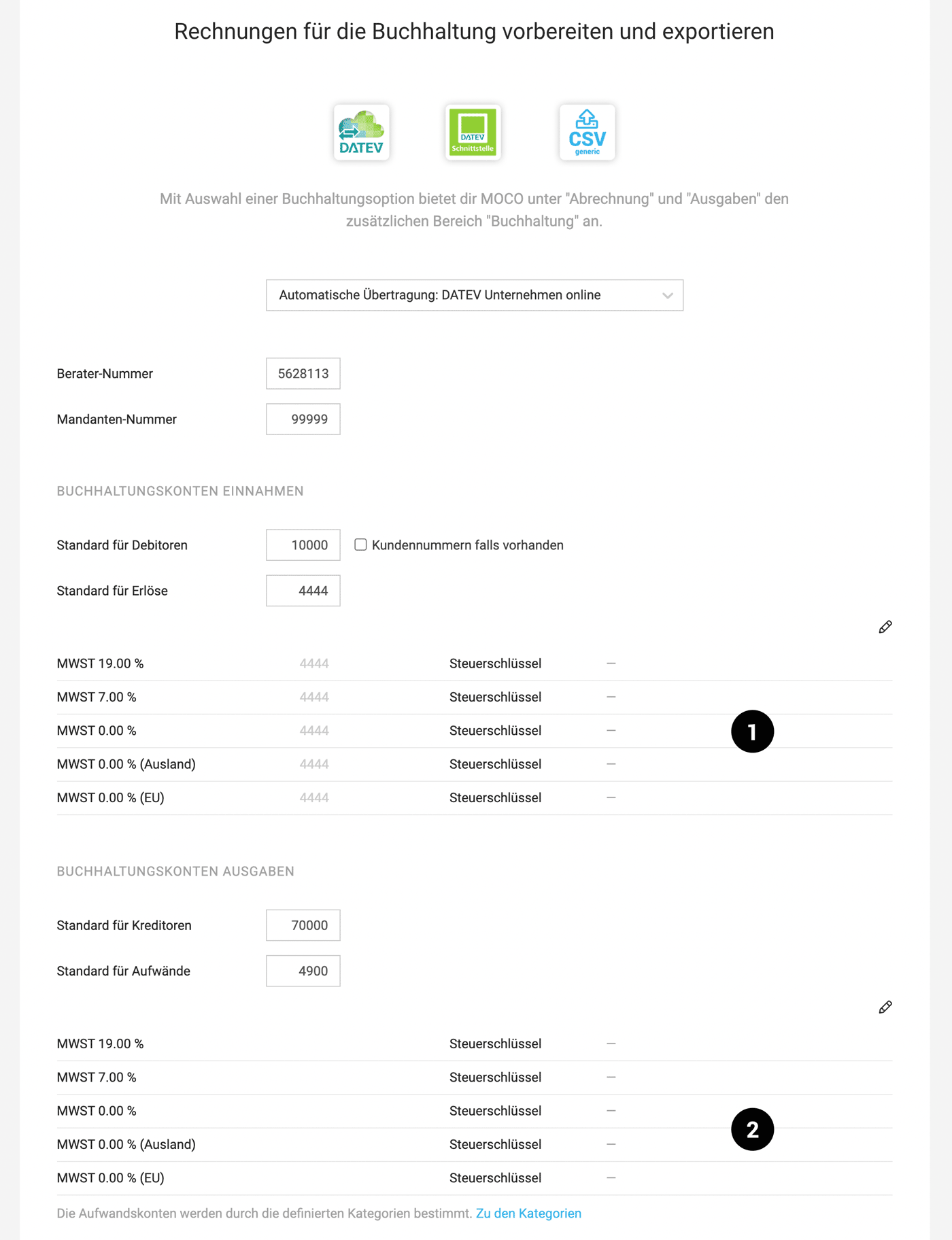

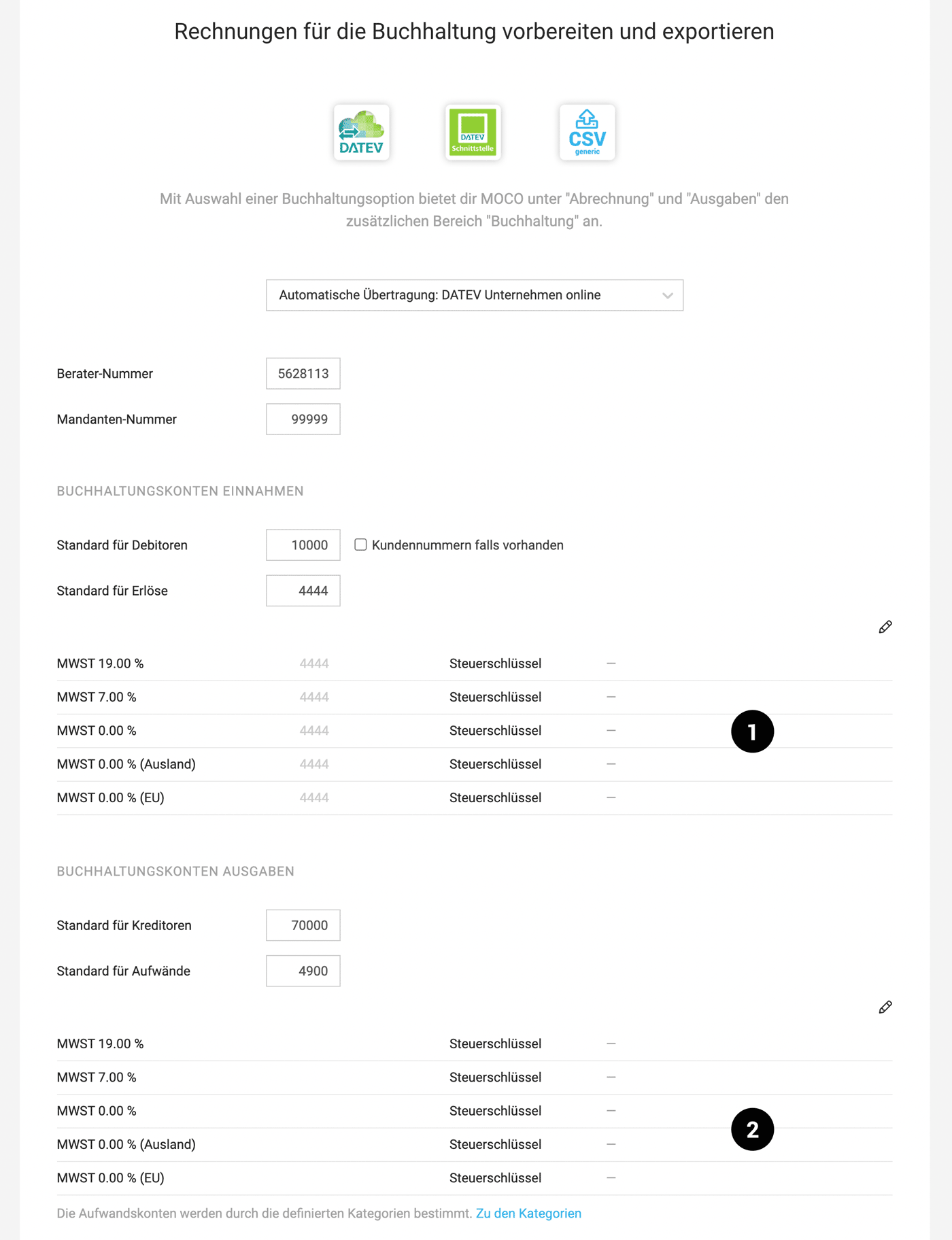

Managing tax codes and revenue accounts

In the settings under "Invoicing", you manage the tax codes for the tax rates. Each in the section for revenues (1) and expenses (2). You can also store the revenue accounts for the different tax rates here. The expense accounts are controlled via the individually definable categories.

English image not yet available...

English image not yet available...

The tax codes and revenue accounts are also part of the accounting exports.

Tax rates on track

Most will have noticed – the previously free entry for the tax rate has been secretly replaced by a fixed selection. The selection of tax rates can be supplemented if needed – but for now only by us. So if you use special tax rates for certain reasons (e.g., as an Austrian account the temporary reduced tax rate of 5% for books), then just contact us via the service at the bottom right (or select "Contact Form" in the footer).

Managing tax codes and revenue accounts

In the settings under "Invoicing", you manage the tax codes for the tax rates. Each in the section for revenues (1) and expenses (2). You can also store the revenue accounts for the different tax rates here. The expense accounts are controlled via the individually definable categories.

English image not yet available...

English image not yet available...The tax codes and revenue accounts are also part of the accounting exports.