Alter News-Artikel!

» Hier geht's zur aktuellen Online-Hilfe

Article from

New Settings for Invoicing.

The settings for Expenses and Invoicing have been revised, restructured, and supplemented with manageable tax rates. Here we present the most important updates:

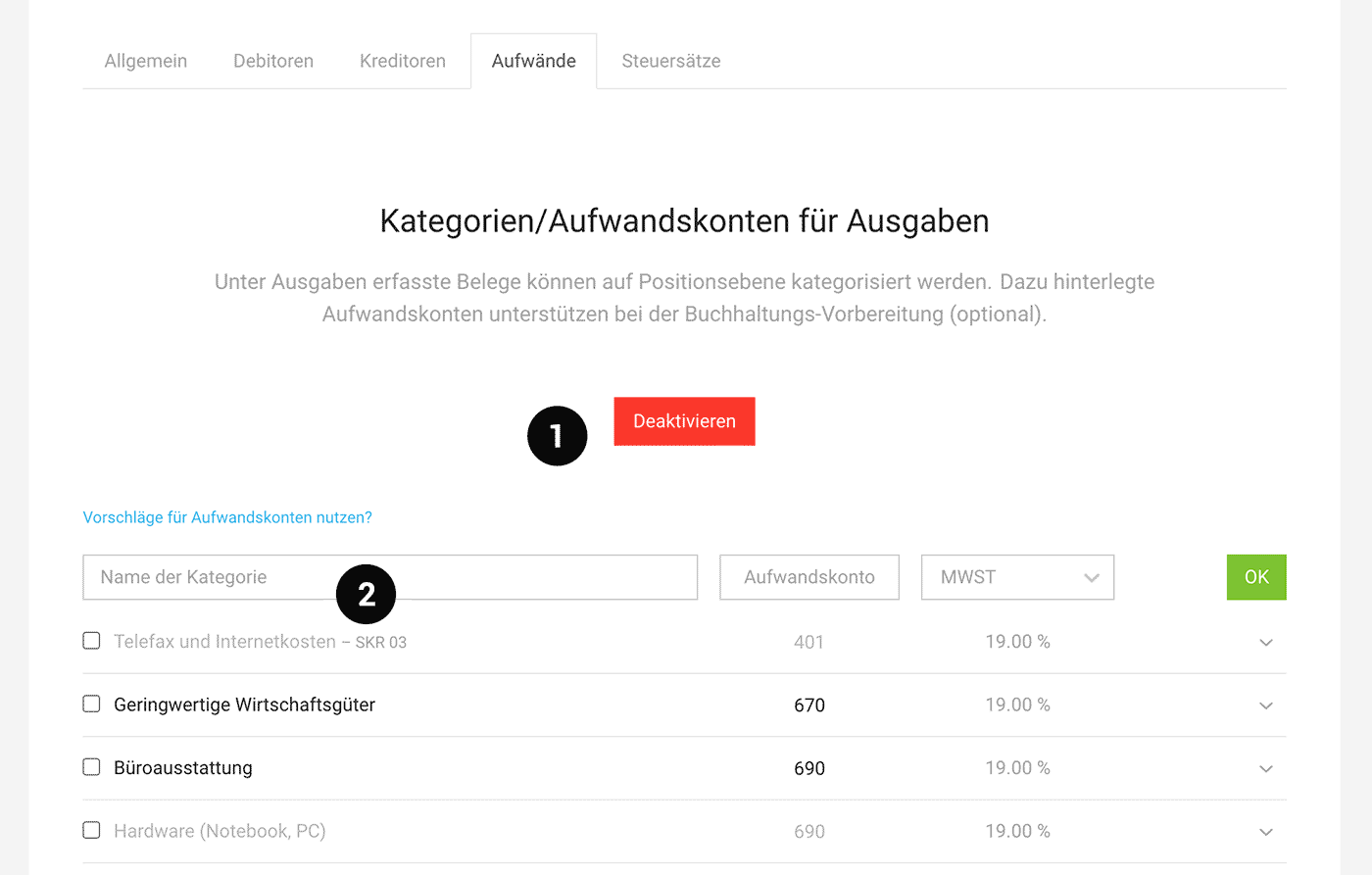

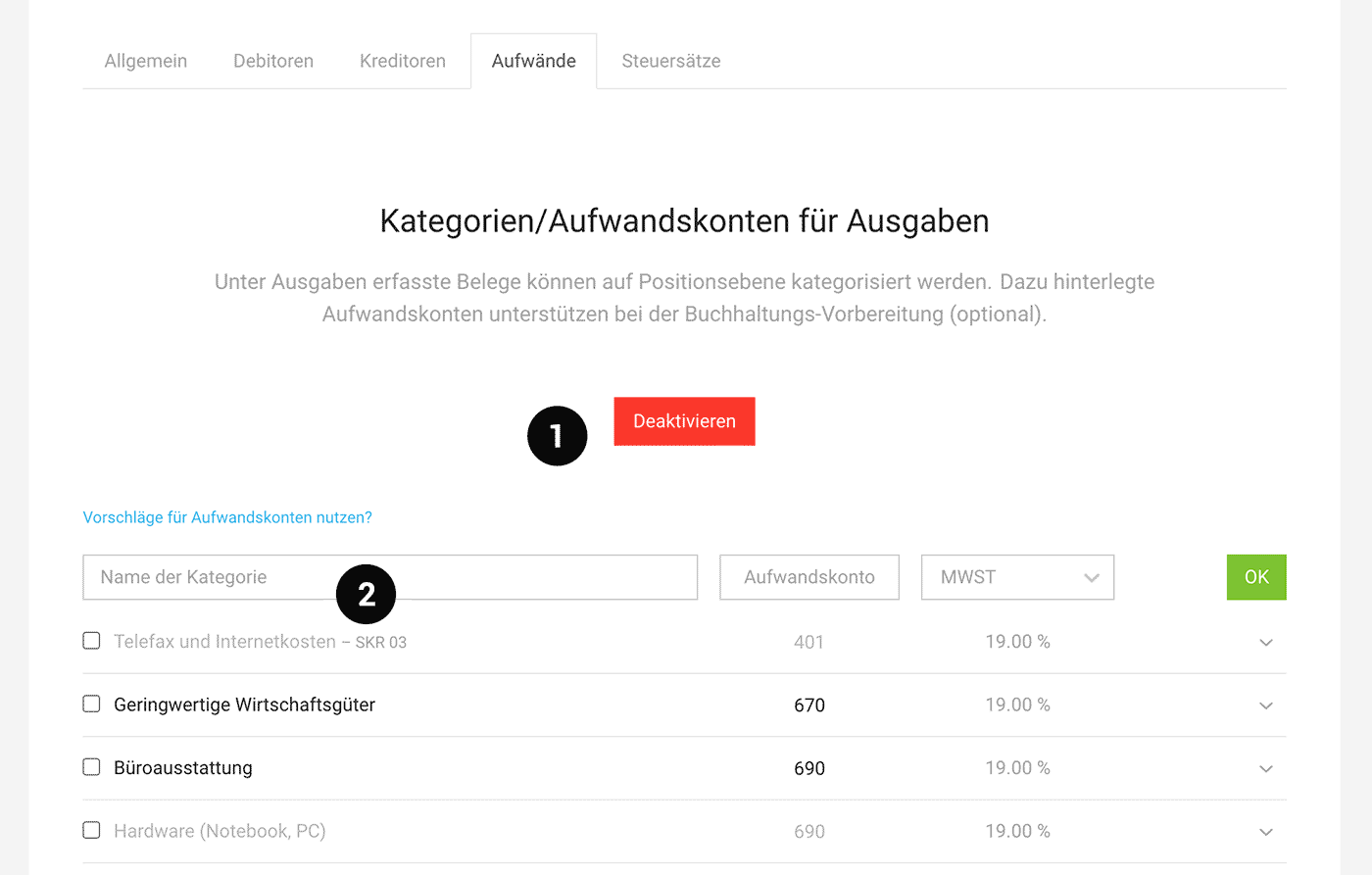

Expense Categories Move to Invoicing

Categories (including expense accounts) can be activated and managed as before. Since they primarily play an accounting role, they have been moved to the "Invoicing" settings menu under the new tab "Expenses."

Background: Capturing expenses without categories is faster and offers the greatest added value with DATEV Unternehmen online. Otherwise, the expense accounts can also be assigned later in the invoicing process. With upcoming developments, an individual consideration of cost centers/profit centers will be possible.

English image not yet available...

English image not yet available...

(1) Activate categories

(2) Record categories and choose suggestions

Background: Capturing expenses without categories is faster and offers the greatest added value with DATEV Unternehmen online. Otherwise, the expense accounts can also be assigned later in the invoicing process. With upcoming developments, an individual consideration of cost centers/profit centers will be possible.

English image not yet available...

English image not yet available...(1) Activate categories

(2) Record categories and choose suggestions

Personal Expenses Get Their Own Page

The Personal expenses function is now activated in its own tab under "Expenses" > "Personal expenses". After activation, categories can be selected.

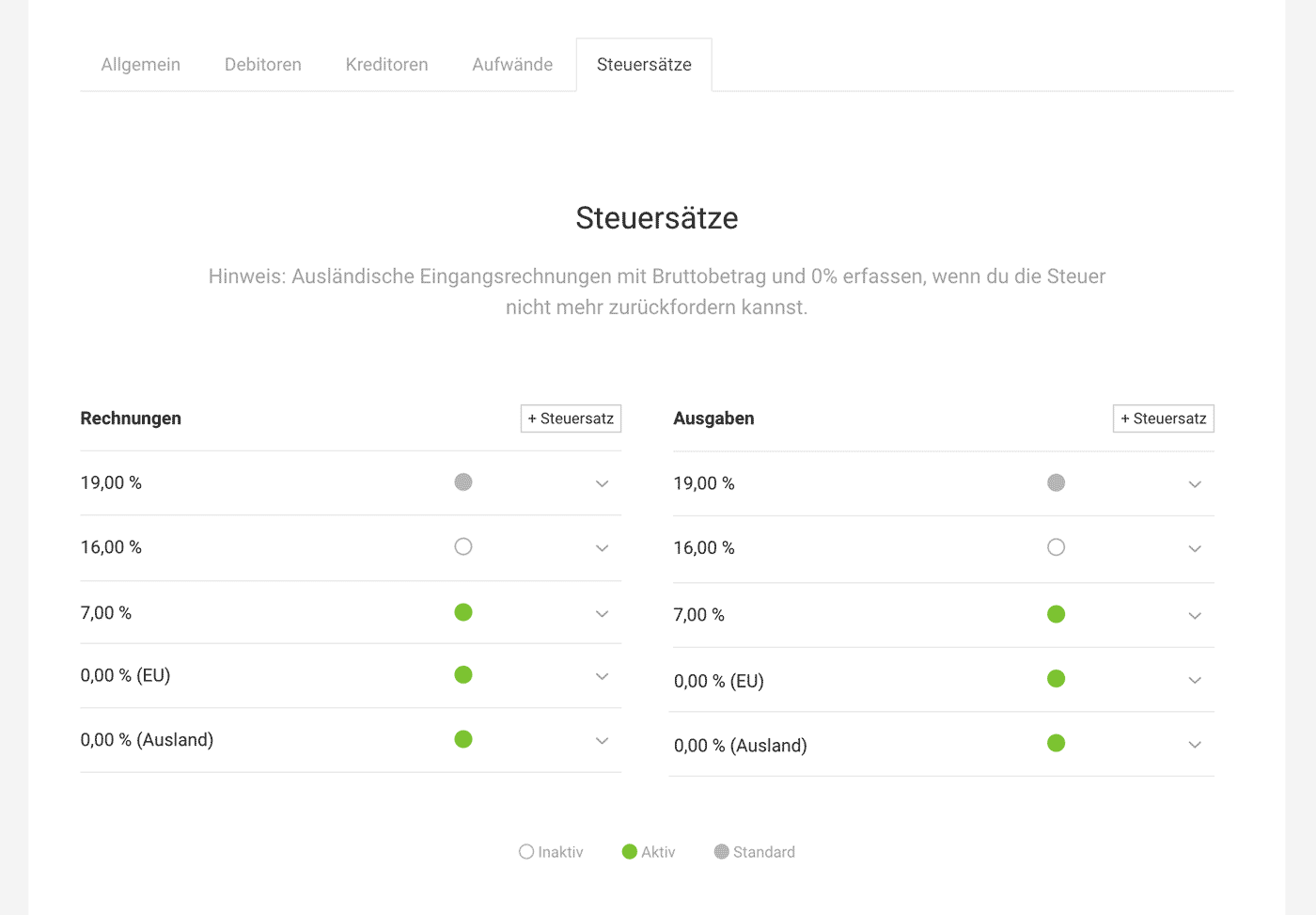

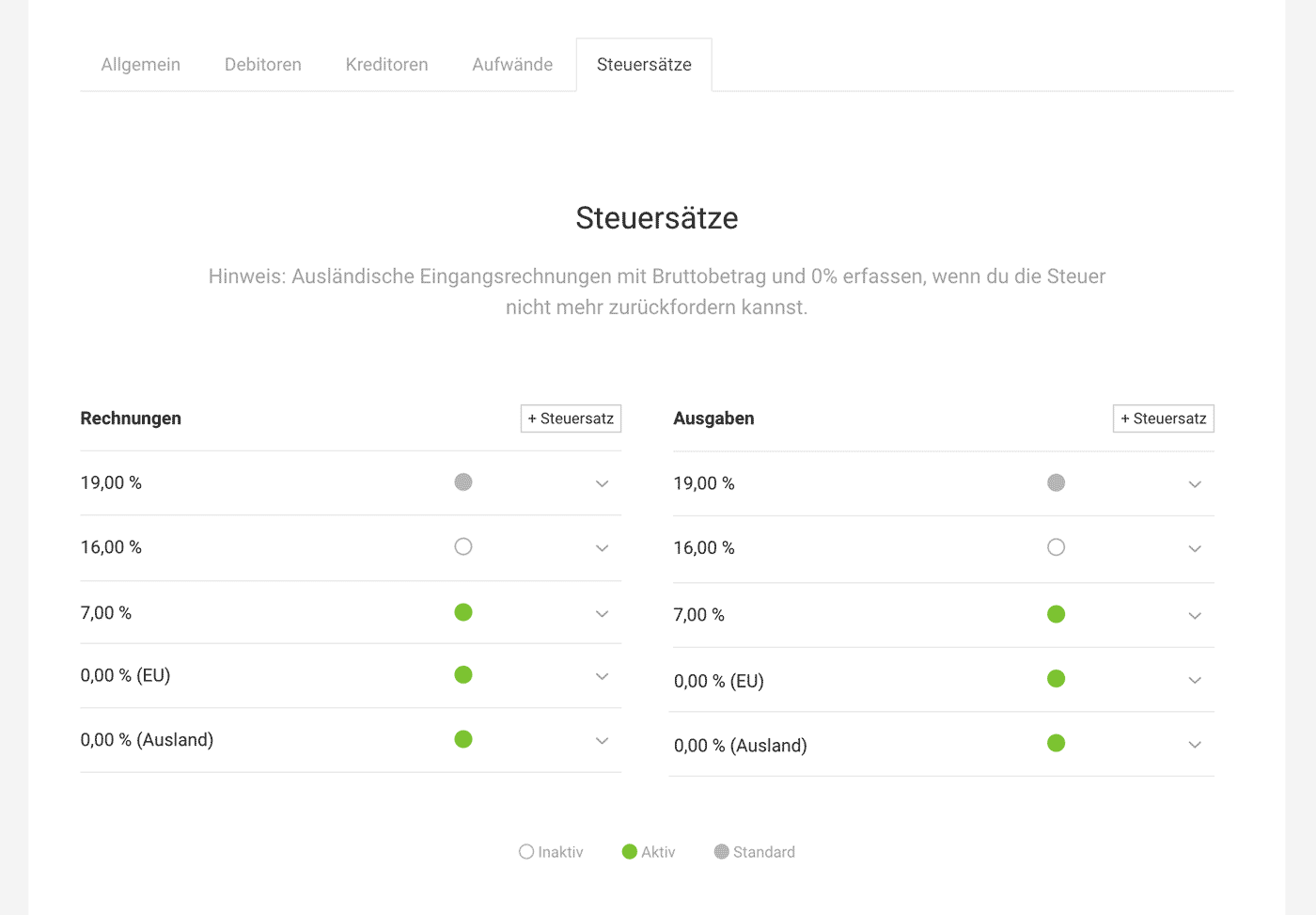

New: Tax Rates

Under "Invoicing" you can now find the tax rates of the account. You can select the standard tax rate there and add additional tax rates if needed, e.g., if you are also registered as a business in another country.

Note: Expenses with tax from abroad and the EU are always recorded with the gross amount 0% (EU) or 0% (foreign) if you cannot reclaim the input tax.

English image not yet available...

English image not yet available...

Note: Expenses with tax from abroad and the EU are always recorded with the gross amount 0% (EU) or 0% (foreign) if you cannot reclaim the input tax.

English image not yet available...

English image not yet available...