Article from

Adjustment of VAT Rates in 2024 and DSG Starting September 2023

English image not yet available...

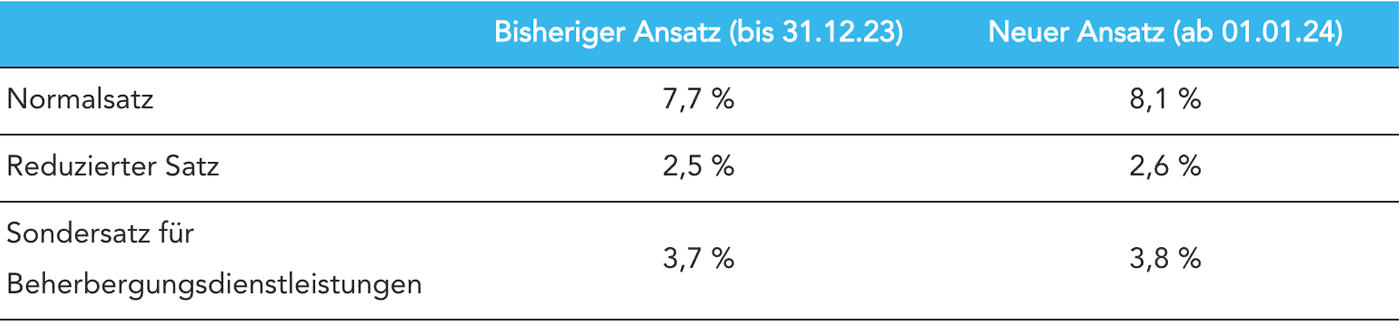

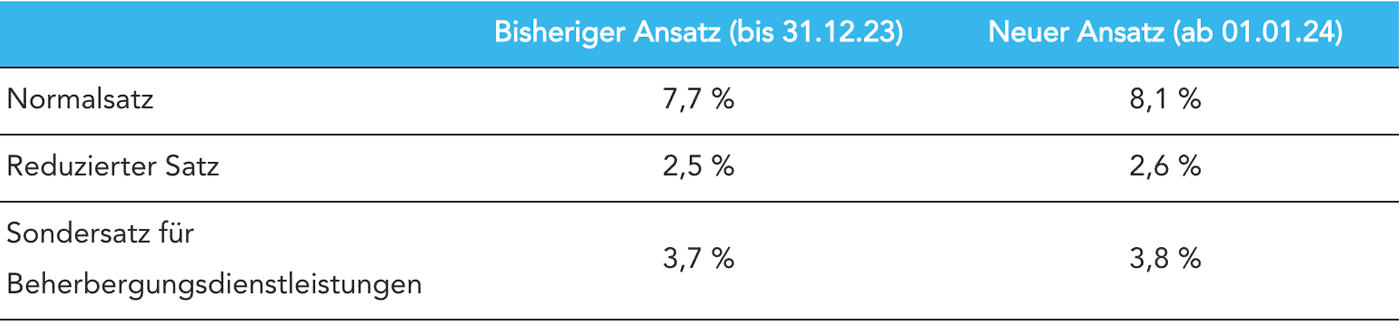

English image not yet available...New VAT Rates from January 1, 2024

Starting in 2024, new value-added tax rates will apply in Switzerland.

English image not yet available...

English image not yet available...

English image not yet available...

English image not yet available...For service providers, this means

The standard VAT rate of 7.7% will be increased to 8.1%. Service providers must therefore invoice services up to the end of 2023 at 7.7% and services from January 1, 2024, at 8.1%. The period of performance is applicable.

Partial invoices for cross-year contracts

The tax administration recommends for contracts that are not completed by the end of 2023 and extend into 2024, to correctly delineate partial invoices. List started services in terms of type, scope, and time (or period).

The tax administration recommends for contracts that are not completed by the end of 2023 and extend into 2024, to correctly delineate partial invoices. List started services in terms of type, scope, and time (or period).

How to succeed in the transition with MOCO

Invoices

1. Inform customers

Inform customers in advance for cross-year projects that due to the VAT change, services for 2023 will be invoiced in advance.

Inform customers in advance for cross-year projects that due to the VAT change, services for 2023 will be invoiced in advance.

2. Invoice period 2023

Invoice all services up to 31.12.2023 at the end of the year with 7.7%.

3. Transition to new tax rate

In the settings under "Accounting" > "Tax rates" select 8.1% as the standard.

Info 30.01.24: The standard has now been set to 8.1% for everyone. If you still need to create invoices with 7.7%, simply select this tax rate alternatively via the dropdown.

Invoice all services up to 31.12.2023 at the end of the year with 7.7%.

3. Transition to new tax rate

In the settings under "Accounting" > "Tax rates" select 8.1% as the standard.

Info 30.01.24: The standard has now been set to 8.1% for everyone. If you still need to create invoices with 7.7%, simply select this tax rate alternatively via the dropdown.

4. Invoice period 2024

Invoice services for 2024 with the new tax rate.

Once you no longer need the rates for 2023, you can deactivate them in the settings so they do not burden the tax rate selection. Until then, you benefit from the flexibility of both tax rates during the transition phase and can decide individually for each invoice or override the standard.

Invoice services for 2024 with the new tax rate.

Once you no longer need the rates for 2023, you can deactivate them in the settings so they do not burden the tax rate selection. Until then, you benefit from the flexibility of both tax rates during the transition phase and can decide individually for each invoice or override the standard.

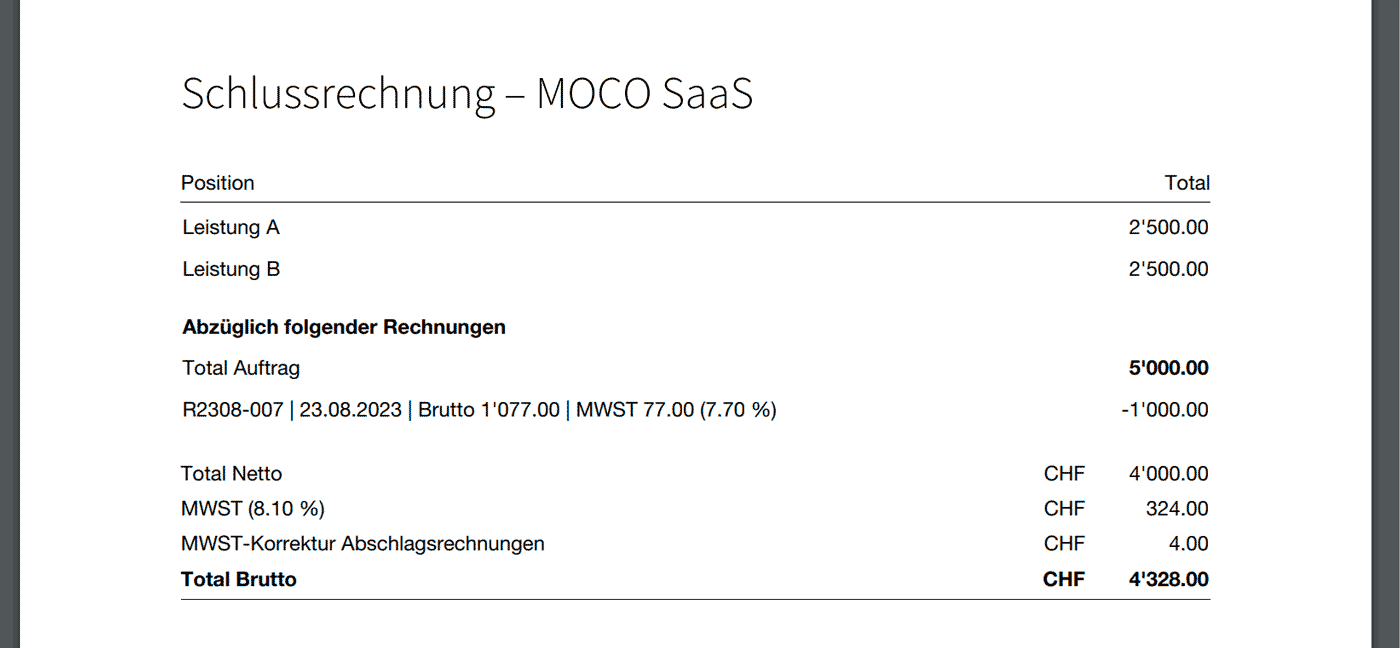

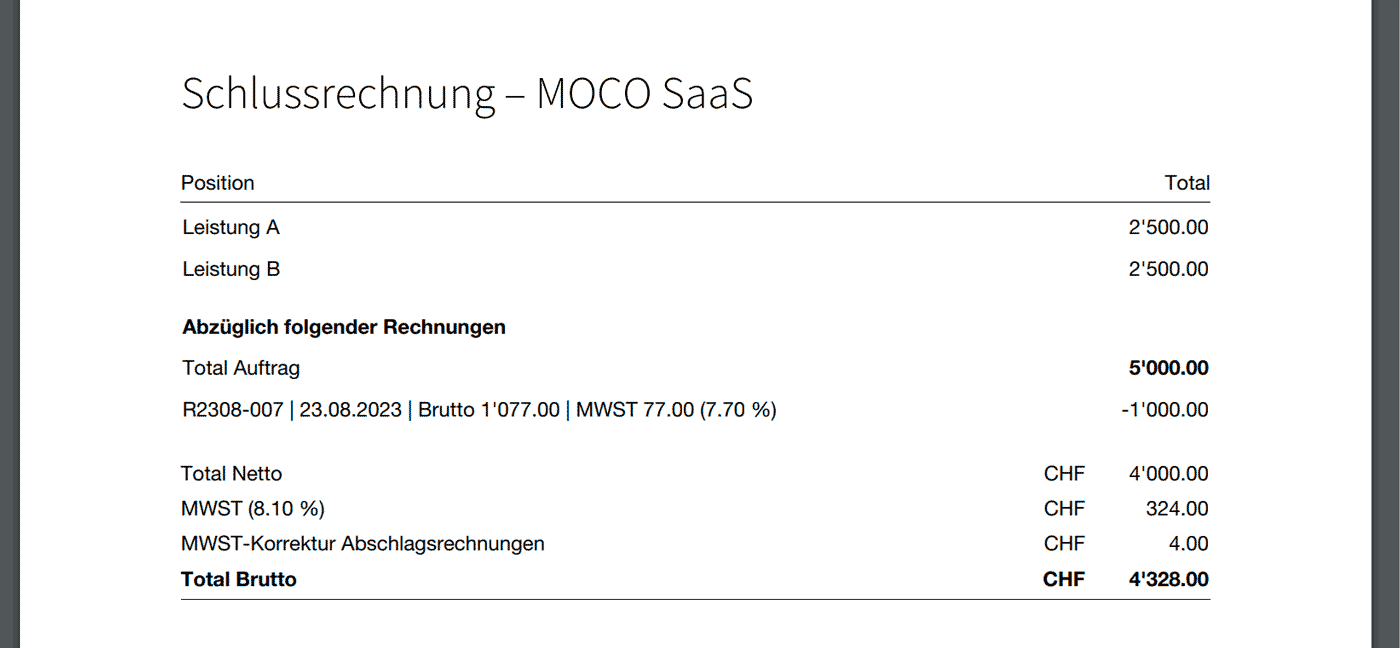

Advance and final invoices

If an advance invoice is created at 7.7% and the final invoice in 2024 is due at 8.1%, MOCO automatically issues a VAT correction when using the "Advance invoice" automation.

Example:

English image not yet available...

English image not yet available...

! Due to the complexity of the matter and possible special cases, we recommend clarification with the tax administration or your fiduciary office.

Example:

English image not yet available...

English image not yet available...! Due to the complexity of the matter and possible special cases, we recommend clarification with the tax administration or your fiduciary office.

Cross-year services

Cross-year services such as subscriptions or hosting fees must be invoiced separately for the time periods. In some cases, cross-year services can also be fully invoiced at 8.1%.

! For safety, we recommend clarification with the tax administration or your fiduciary office.

! For safety, we recommend clarification with the tax administration or your fiduciary office.

Proposals

💡Proposals that refer to services in 2024 should already be created with 8.1% so that the correct tax rate is set when invoicing.

Expenses

1. Close 2023

Record all invoices with the service period in 2023 with the old tax rates.

2. Transition to new tax rate

In the settings under "Accounting" > "Tax rates" select 8.1% as the standard.

Record all invoices with the service period in 2023 with the old tax rates.

2. Transition to new tax rate

In the settings under "Accounting" > "Tax rates" select 8.1% as the standard.

3. When using accounting export: Adjust tax keys (in the settings > Accounting).

3. When using expense accounts/categories: Adjust tax rates for expense accounts (in the settings > Accounting).

3. When using expense accounts/categories: Adjust tax rates for expense accounts (in the settings > Accounting).

General

Once you no longer need the rates for 2023, you can deactivate them in the settings so they do not burden the tax rate selection. Until then, you benefit from the flexibility of both tax rates during the transition phase and can decide individually for each invoice or override the standard.

MOCO will automatically deactivate the old tax rates at the end of February. If you still need them in exceptional cases, reactivate them manually.

MOCO will automatically deactivate the old tax rates at the end of February. If you still need them in exceptional cases, reactivate them manually.

Links

DSG from September 1, 2023

Background

On September 1, 2023, the revised version (nDSG) of the Data Protection Act of 1992 comes into force. Among other things, the goal was to harmonize with the General Data Protection Regulation (GDPR) of the EU, and the nDSG ensures that the free flow of data with the EU can continue.

What does this mean for me in connection with MOCO

The new DSG covers data of natural persons – i.e., all users and contacts in MOCO. As a company, you are obliged to comply with the new provisions. This also includes choosing a reputable software provider that provides a data processing agreement (DPA). This clearly outlines how personal data is handled.

DPA from September

From September 1, 2023, the standard data processing agreement (also called DPA) will be available for confirmation in your MOCO account.

The account holder will receive a message and be directed to the DPA with a click.

All information on data protection in accordance with the stricter EU GDPR, including a list of all subcontractors with countries and possible opt-outs.

DPA from September

From September 1, 2023, the standard data processing agreement (also called DPA) will be available for confirmation in your MOCO account.

The account holder will receive a message and be directed to the DPA with a click.

All information on data protection in accordance with the stricter EU GDPR, including a list of all subcontractors with countries and possible opt-outs.