Alter News-Artikel!

» Hier geht's zur aktuellen Online-Hilfe

Article from

MOCO & DATEV: The Direct Connection.

Included in the subscription: With the direct connection to DATEV, MOCO offers not only manual export but also automatic transfer including documents.

English image not yet available...

English image not yet available...General Information

🏅 Official DATEV Partner

In addition to manual accounting export, the direct connection is now also operational. Using the test scenarios agreed with the manufacturer for this interface, DATEV has confirmed the technically error-free data exchange. MOCO has been an official DATEV partner since February 2021.

☝️ Overview of the interface

MOCO now supplements

In addition to manual accounting export, the direct connection is now also operational. Using the test scenarios agreed with the manufacturer for this interface, DATEV has confirmed the technically error-free data exchange. MOCO has been an official DATEV partner since February 2021.

☝️ Overview of the interface

MOCO now supplements

With the API interface, DATEV Invoice Data Service 1.0, incoming and outgoing invoices can be transmitted as document images with invoice information from the partner solution to DATEV Unternehmen online without media disruption. The transmitted data can be processed as a booking suggestion in DATEV accounting.

With the file interface, DATEV format, transaction data can be transferred to DATEV accounting. Detailed information can be found in the PDF document: Scope of the DATEV format interface.

🤝 Free consulting from DATEV on ordering and setting up data services in DATEV

DATEV offers free consulting for tax consultants and companies doing their own bookkeeping, which facilitates the setup of the DATEV Invoice Data Service 1.0. An appointment can be booked here

🤝 Support in finding a tax consultant

If you do not have a tax consultant yet and would like to use the new accounting connection? Tax consultants working with DATEV are listed here at Smart Experts.

Benefits of the Direct Connection

- Great time savings: the data, including documents, are available at the push of a button in the office.

- Security: the transfer is multiply secured.

- The documents remain with the company

Activate connection to DATEV Unternehmen online

1. Requirements

1.1 Your tax consultant has ordered the DATEV Invoice Data Service 1.0 for you and set it up for themselves.

If you do your own financial accounting with DATEV, you can independently commission the Invoice Data Service 1.0 with your tax consultant's consent. More information can be found here.

DATEV offers free support for ordering the data service and setting it up in DATEV – see above.

1.2 For authentication (see 3.), you need DATEV SmartLogin. Access to DATEV SmartLogin is provided after successful ordering of the interface. If you already have a DATEV Smart Login access, it will be equipped with the necessary rights during the commissioning process.

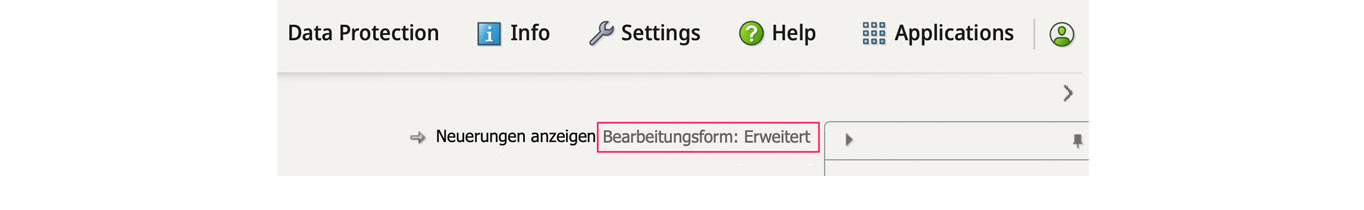

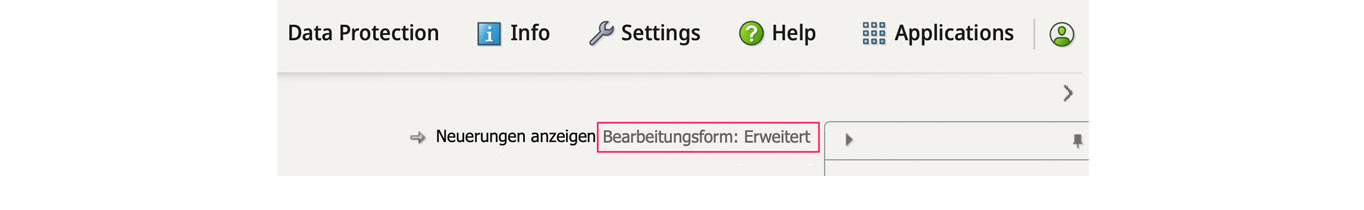

1.3 In DATEV Unternehmen online, the extended editing form is activated (see illustration).

English image not yet available...

English image not yet available...

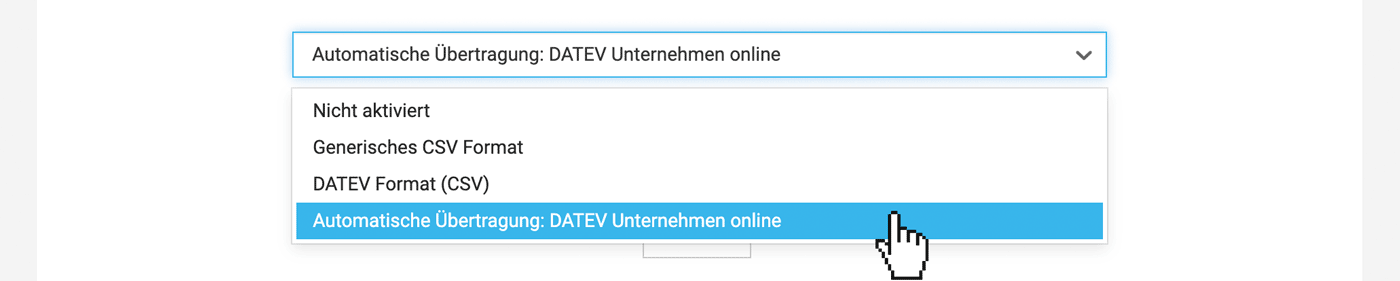

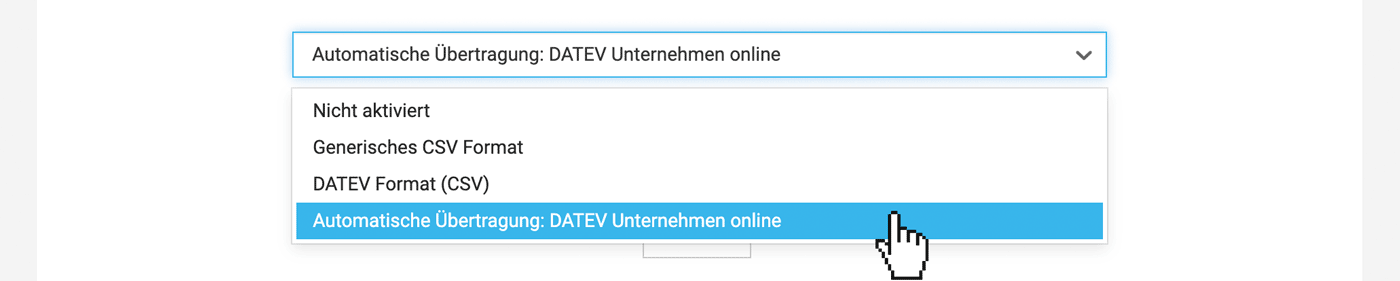

2. Choose setting in MOCO

In the settings under "Accounting" select the option "Automatic Transfer – DATEV Unternehmen Online".

English image not yet available...

English image not yet available...

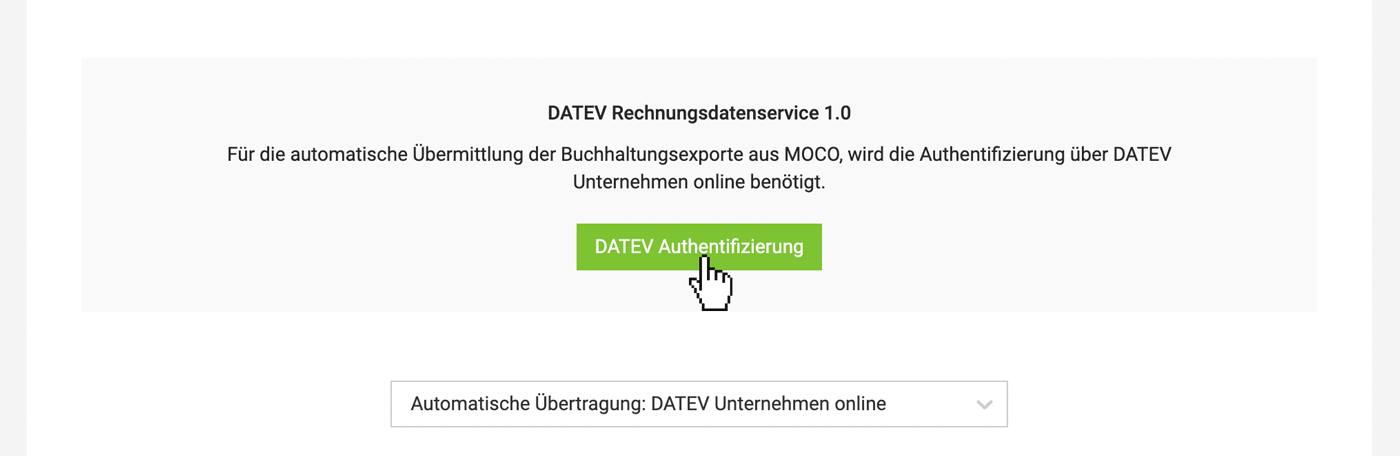

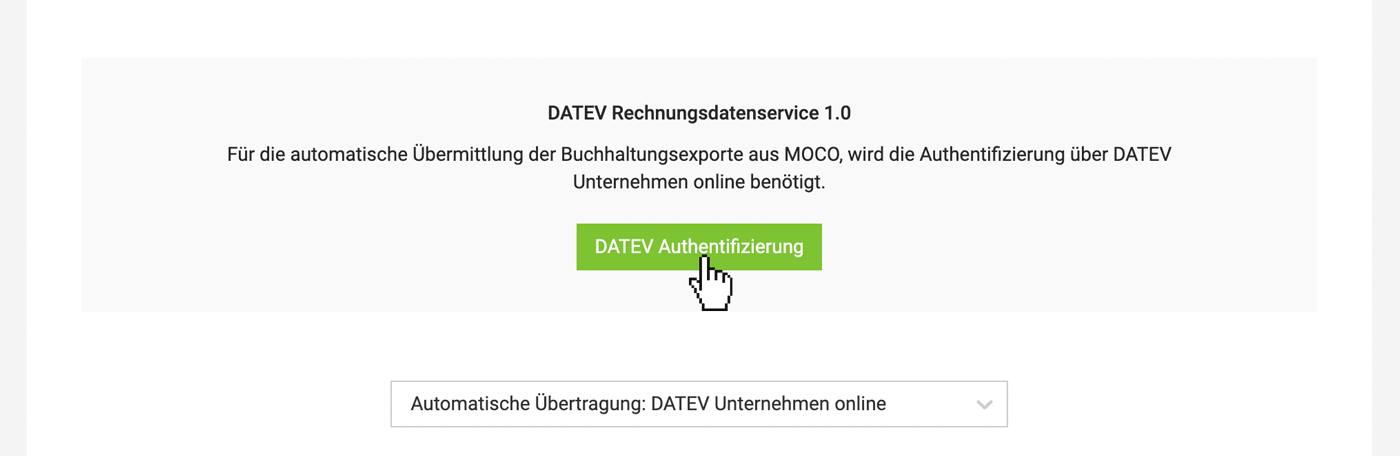

3. Authenticate with DATEV

English image not yet available...

English image not yet available...

4. Enter your accounting accounts

Now MOCO is ready to transfer incoming and outgoing invoices to DATEV Unternehmen online for this account.

If you do your own financial accounting with DATEV, you can independently commission the Invoice Data Service 1.0 with your tax consultant's consent. More information can be found here.

DATEV offers free support for ordering the data service and setting it up in DATEV – see above.

1.2 For authentication (see 3.), you need DATEV SmartLogin. Access to DATEV SmartLogin is provided after successful ordering of the interface. If you already have a DATEV Smart Login access, it will be equipped with the necessary rights during the commissioning process.

1.3 In DATEV Unternehmen online, the extended editing form is activated (see illustration).

English image not yet available...

English image not yet available...2. Choose setting in MOCO

In the settings under "Accounting" select the option "Automatic Transfer – DATEV Unternehmen Online".

English image not yet available...

English image not yet available...3. Authenticate with DATEV

English image not yet available...

English image not yet available...4. Enter your accounting accounts

Now MOCO is ready to transfer incoming and outgoing invoices to DATEV Unternehmen online for this account.

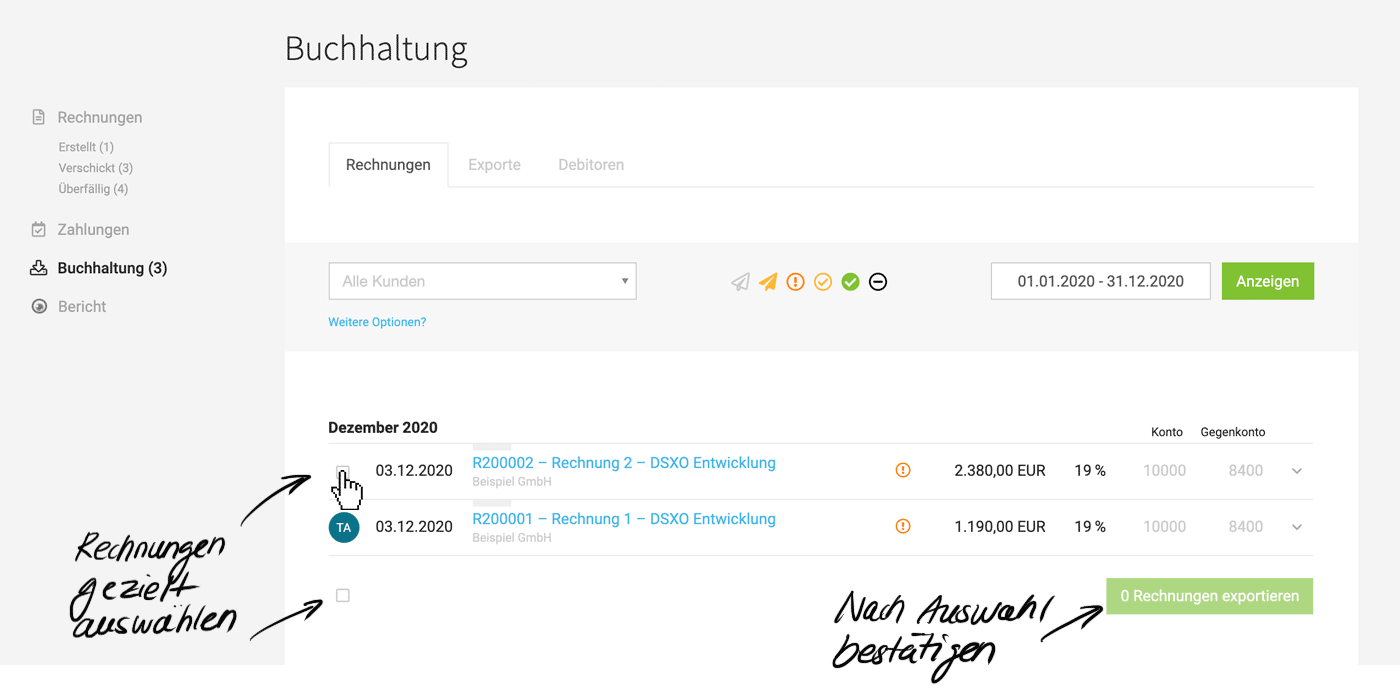

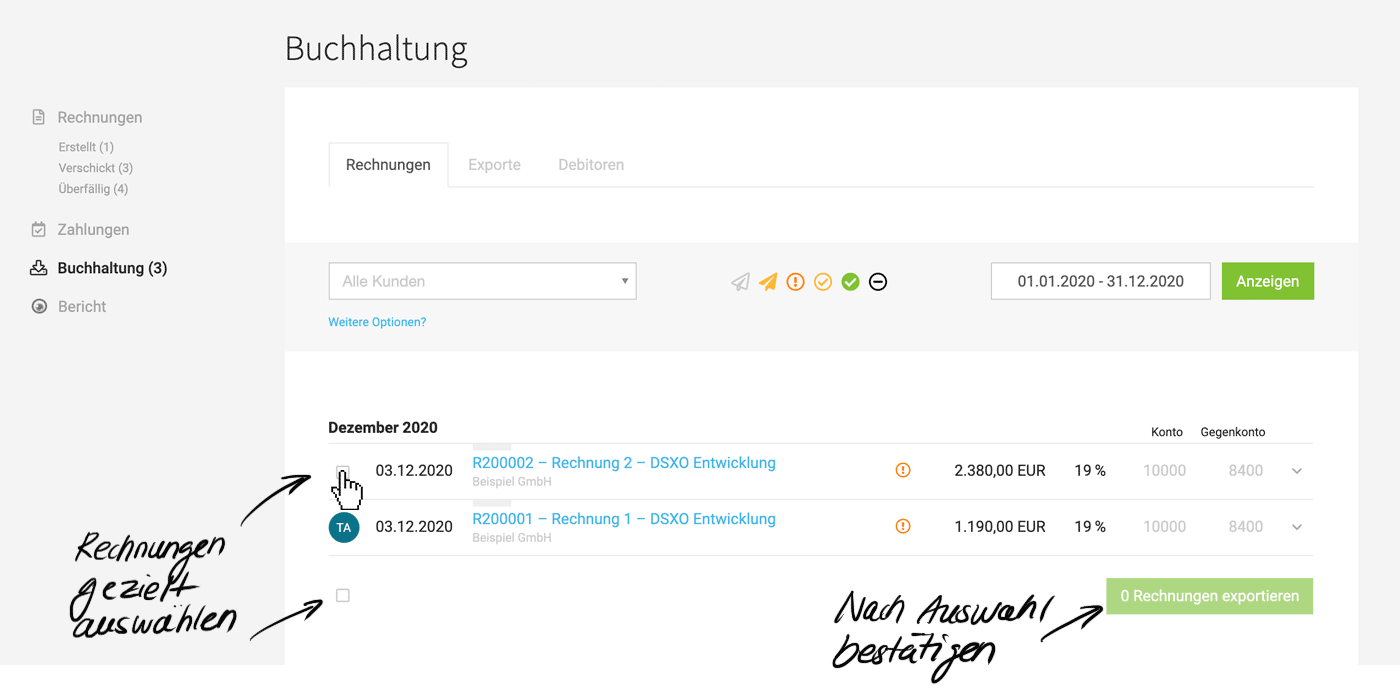

Transfer outgoing and incoming invoices

In the "Invoicing" or "Expenses" section of the "Accounting" menu, you select the invoices and have them (invoice data including documents) transferred to DATEV:

Prepare and select invoices

Select pre-accounted invoices and confirm at the bottom right.

English image not yet available...

English image not yet available...

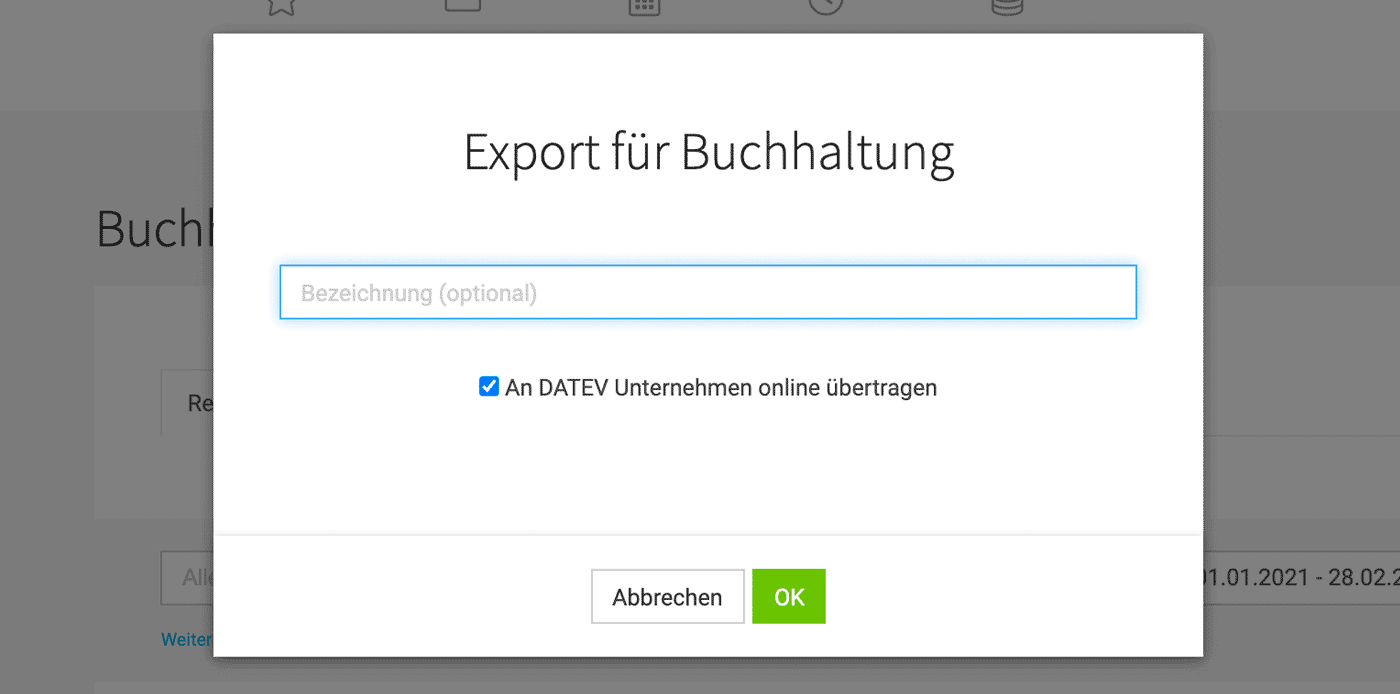

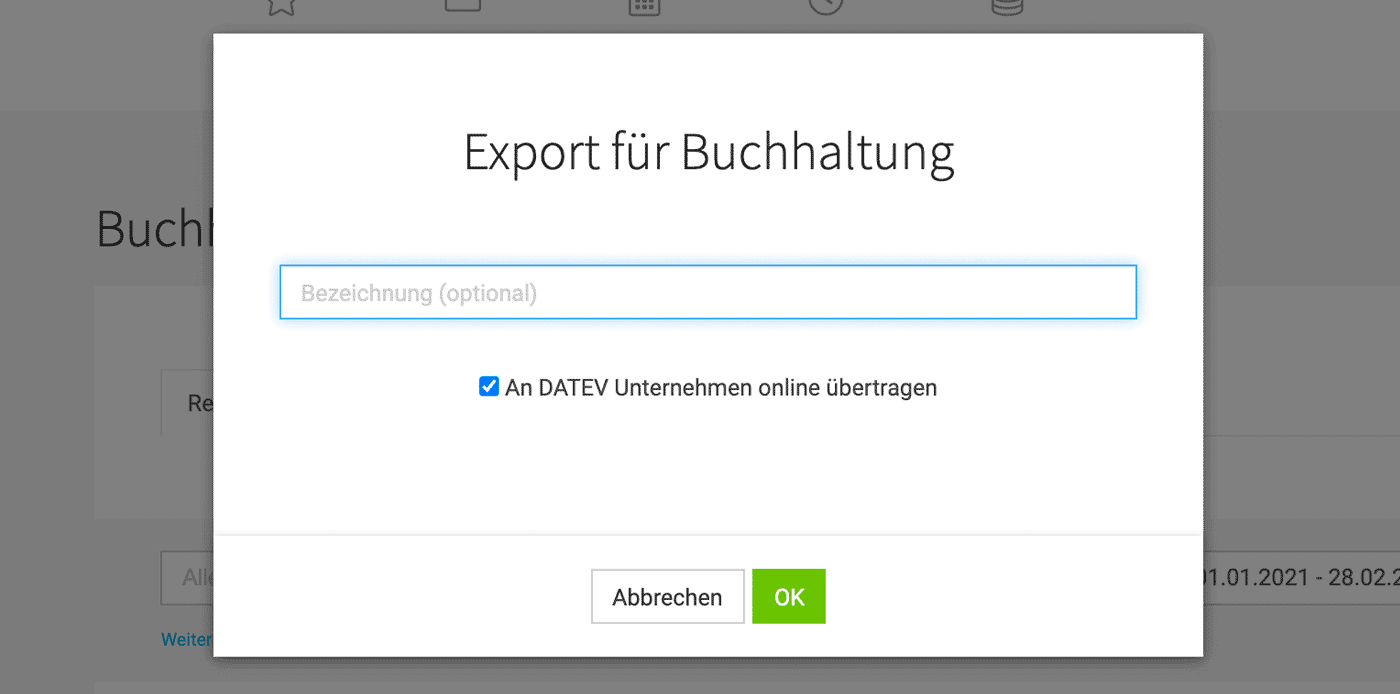

Transfer to DATEV

In the export dialog box, the export can be labeled. For example, "December 2020".

With "OK", the invoice data & documents are transferred to DUO (checkbox is set by default).

English image not yet available...

English image not yet available...

Prepare and select invoices

Select pre-accounted invoices and confirm at the bottom right.

English image not yet available...

English image not yet available...Transfer to DATEV

In the export dialog box, the export can be labeled. For example, "December 2020".

With "OK", the invoice data & documents are transferred to DUO (checkbox is set by default).

English image not yet available...

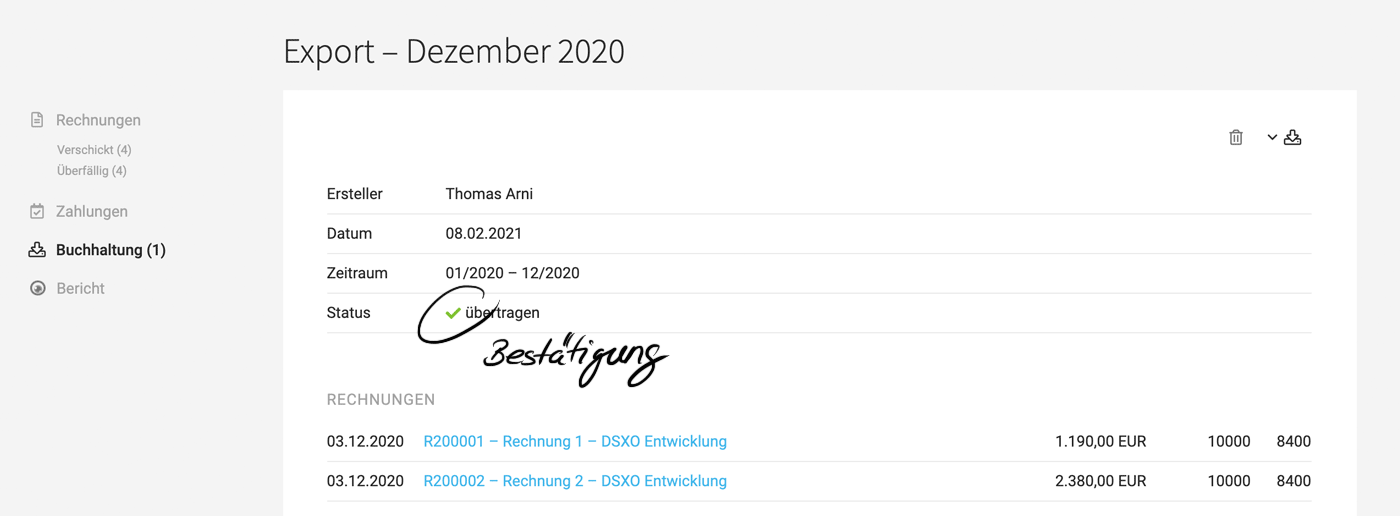

English image not yet available...Confirmed transfer

The successful transfer is indicated by the green checkmark symbol.

English image not yet available...

English image not yet available...