Alter News-Artikel!

» Hier geht's zur aktuellen Online-Hilfe

Article from

Options and Automation for Small Business Owners and Reverse Charge.

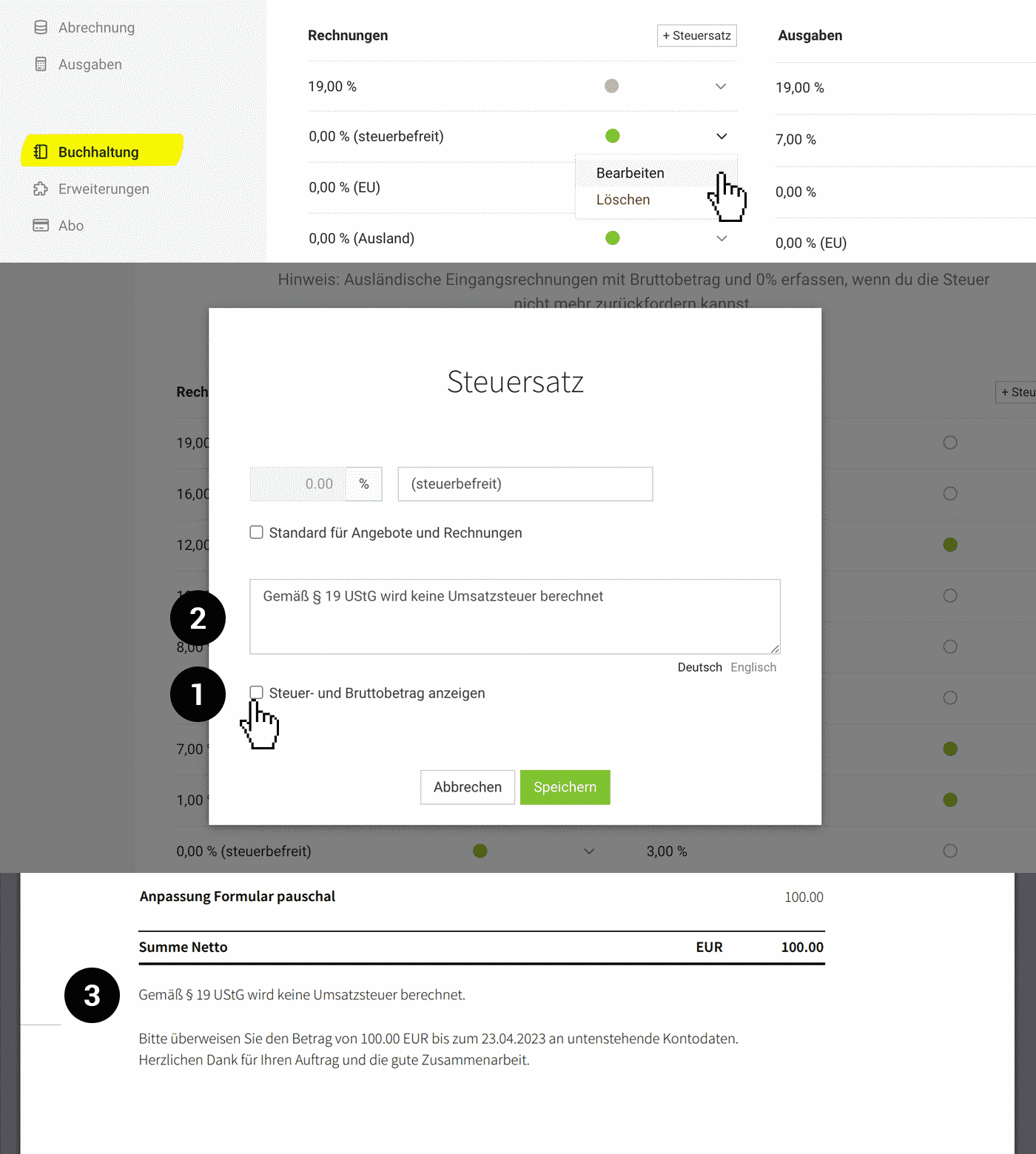

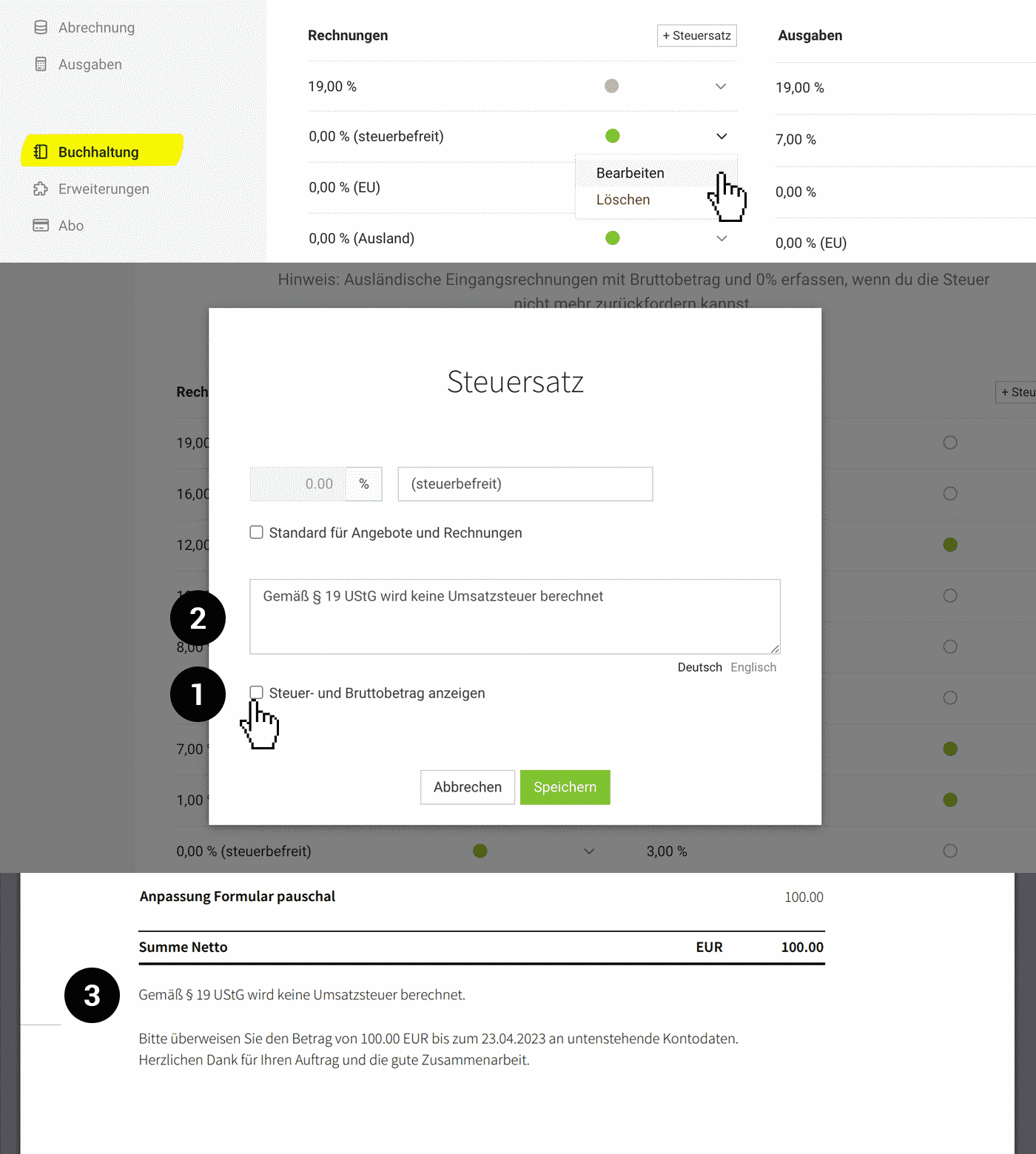

For proposals and invoices that are tax-exempt, for instance, if you fall under the small business regulation or the client is located in another EU country and the reverse charge procedure applies, there are now new configuration options that we showcase here:

Hide Tax Rate and Gross Line

With a tax rate of 0%, MOCO now automatically offers to completely hide tax and gross (1). If needed, adjust the setting under Accounting > Tax Rates.

(English image not yet available)

(English image not yet available)

(English image not yet available)

(English image not yet available)Popular with Small Business Owners

Although "no tax displayed" also corresponds to a display of 0% VAT, some small business owners prefer to hide the lines. This frequently expressed wish has contributed to the prioritization of this development.

Automate Notice

Notice Sentence is Mandatory

Whether it's the small business regulation or reverse charge – an invoice requires a notice explaining why it is tax-exempt.

For example, for the German small business regulation, a text notice like "According to § 19 UStG, no VAT is charged" – or when applying the reverse charge procedure "Tax liability of the service recipient".

You can directly record such a notice sentence at the tax rate (2). It will then automatically appear below the final amount (3). Ensure the legally correct text with your tax office.

For example, for the German small business regulation, a text notice like "According to § 19 UStG, no VAT is charged" – or when applying the reverse charge procedure "Tax liability of the service recipient".

You can directly record such a notice sentence at the tax rate (2). It will then automatically appear below the final amount (3). Ensure the legally correct text with your tax office.

Better Automation for Reverse Charge

For your clients located in another EU country where you invoice using the reverse charge procedure, you usually have already pre-selected the correct tax rate for the client.

Previously, the recommendation was to predefine the reverse charge notice as a different closing text for the client.

This is no longer necessary, as the notice can now be directly stored at the tax rate.

Are you already using the closing text for the reverse charge notice and want to switch?

Proceed as follows:

1. Export clients.

2. Filter for clients with a 0% tax rate.

3. Edit or delete the closing text for these clients.

Previously, the recommendation was to predefine the reverse charge notice as a different closing text for the client.

This is no longer necessary, as the notice can now be directly stored at the tax rate.

Are you already using the closing text for the reverse charge notice and want to switch?

Proceed as follows:

1. Export clients.

2. Filter for clients with a 0% tax rate.

3. Edit or delete the closing text for these clients.