Invoicing

General | Invoices | Cancellation | Reminders | QR Invoice (CH) / QR Code | eBill (CH) | E-Invoices | Not Subject to VAT | Debt CollectionGeneral

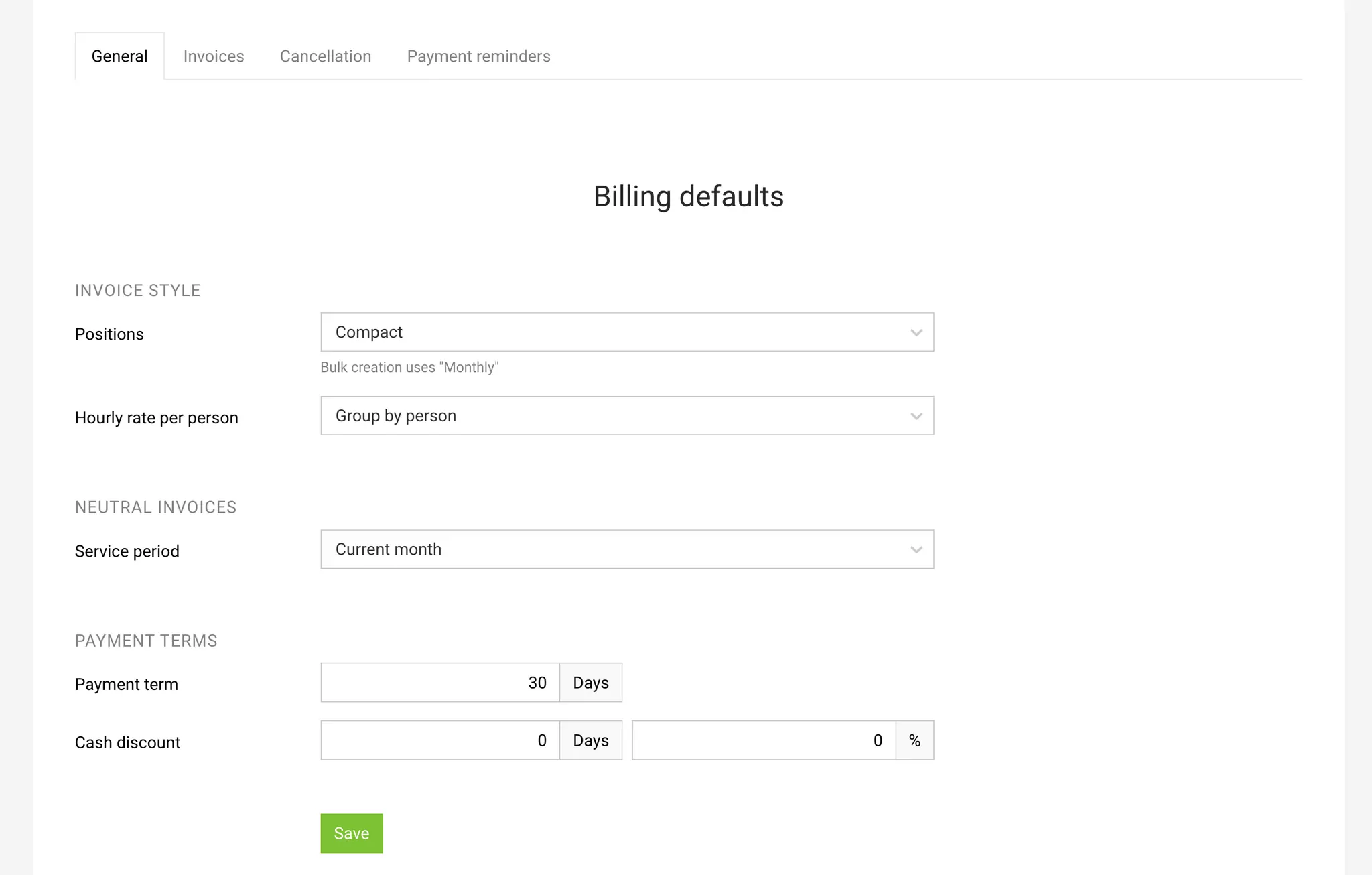

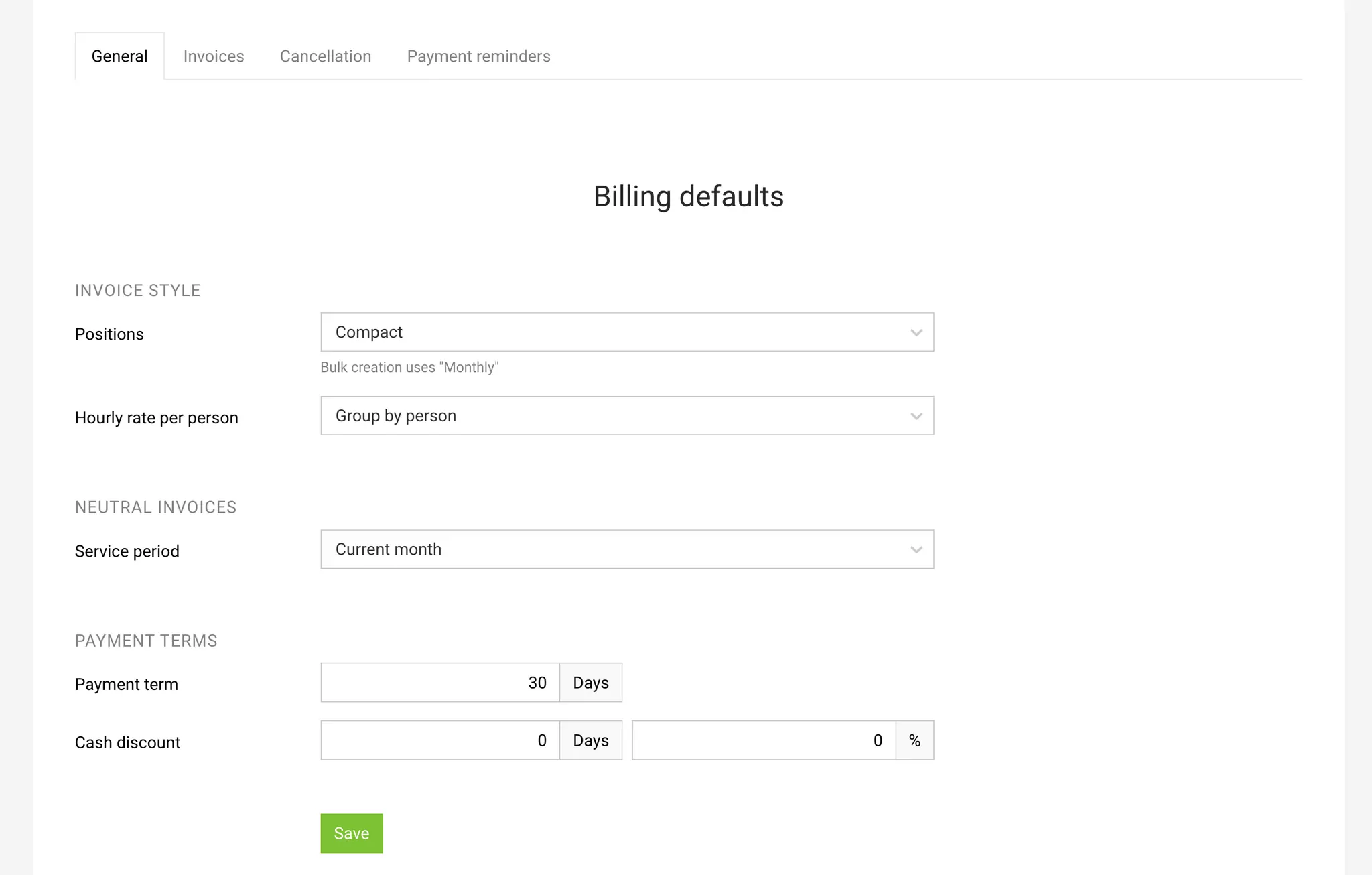

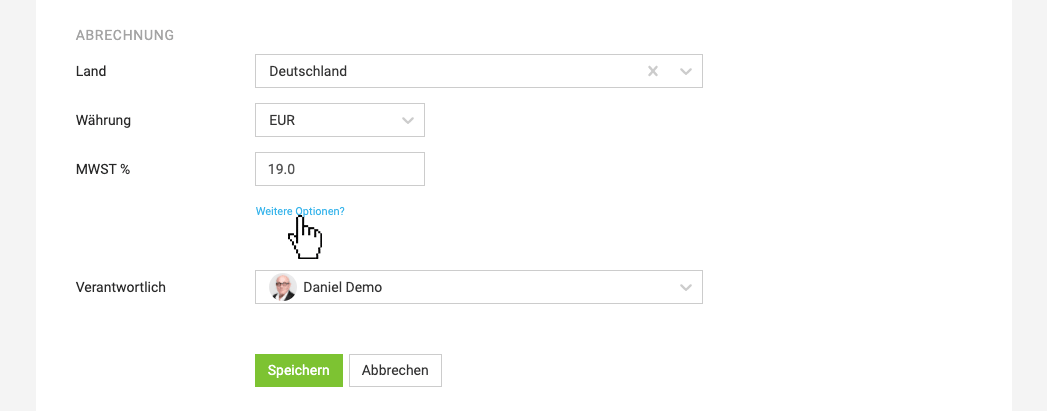

Settings > Invoicing > General

Billable Items

Structure

MOCO offers these options for automatic invoice structuring:

- Monthly Grouped by month

- Detailed Each time entry is listed on the invoice

- Compact No grouping by month

When you select the "Create Invoice" button, MOCO defaults to the standard chosen here. You can always select a different option directly during invoicing via the dropdown menu.

Hourly Rate by Person

If "Hourly Rate by Person" is selected in the project, MOCO offers these options for invoicing hours:

- Group by Person

- Group by Service (Detailed Item) Displays the service, total, and number of hours

- Group by Service (Flat Rate Item) Displays service and total

Hours (or Conversion to Days)

In projects billed based on effort (Time & Material), hours are typically billed as hours. Companies that bill only by daily rates can activate the Conversion to Days here and specify the conversion factor.

Timesheet

When billing based on effort, the appropriate timesheet is automatically created. Whether the timesheet should be part of the PDF is defined at the client or project level under "Invoicing" > "Invoicing Info". Alternatively, it can be included in individual invoices at the end of the form. The timesheet is then directly integrated into the PDF.

Neutral Invoices

Service Period

For most invoices, MOCO can derive and suggest the period from existing data. For neutral invoices—empty invoice forms that are filled individually or created from templates by copying—you select your preferred standard.

Payment Terms

Payment Deadline

The globally defined payment deadline applies to all invoices. It can be set differently at the client level.

Discount

Standard discount conditions are defined here. They can be overridden at the client or invoice level.

Automatically Request Approval

For the approval workflow, you can set up automation by adjusting the individual minimum amount.

Bild Invoicing-Approval-Automatic konnte nicht geladen werden!

Invoices

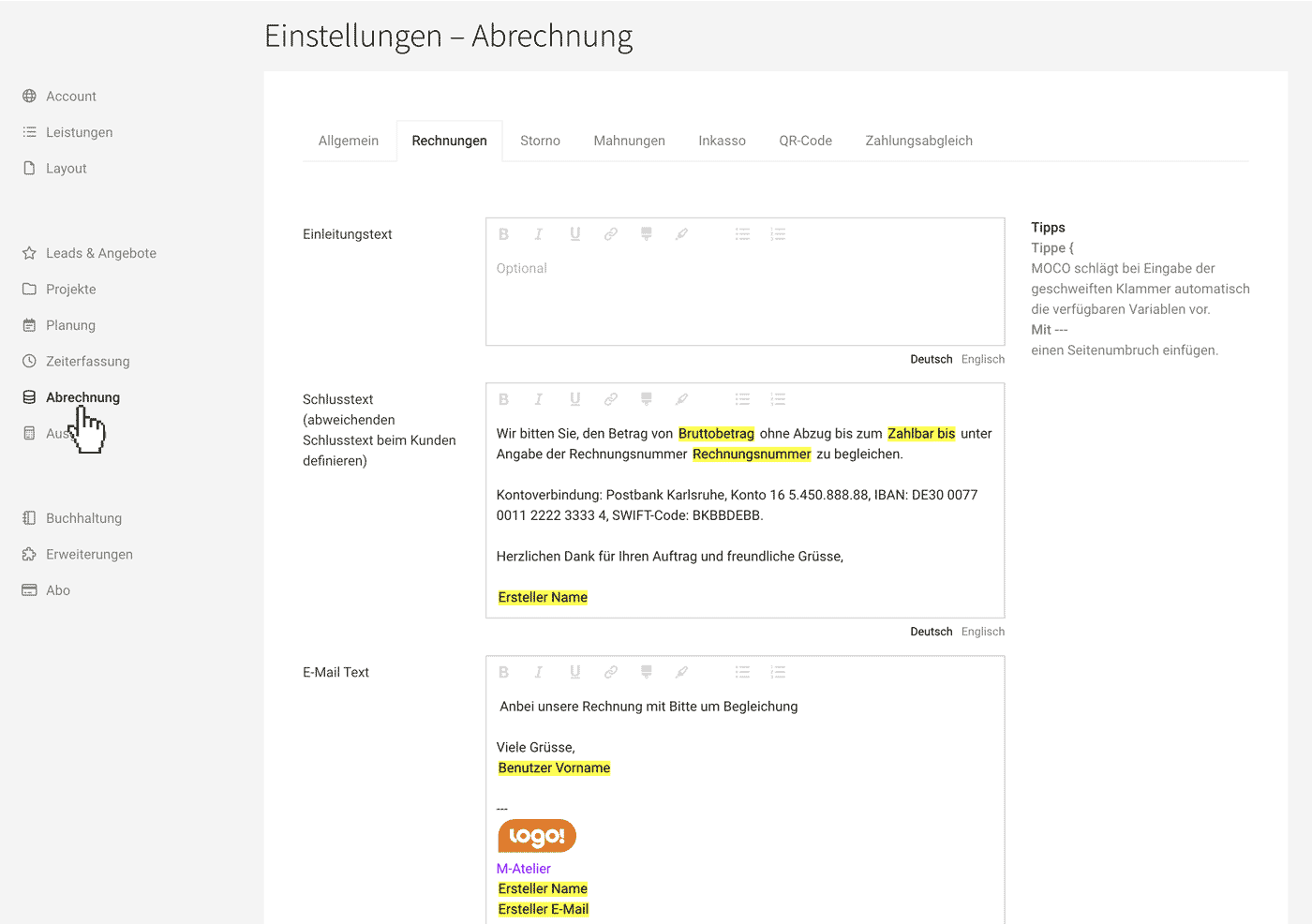

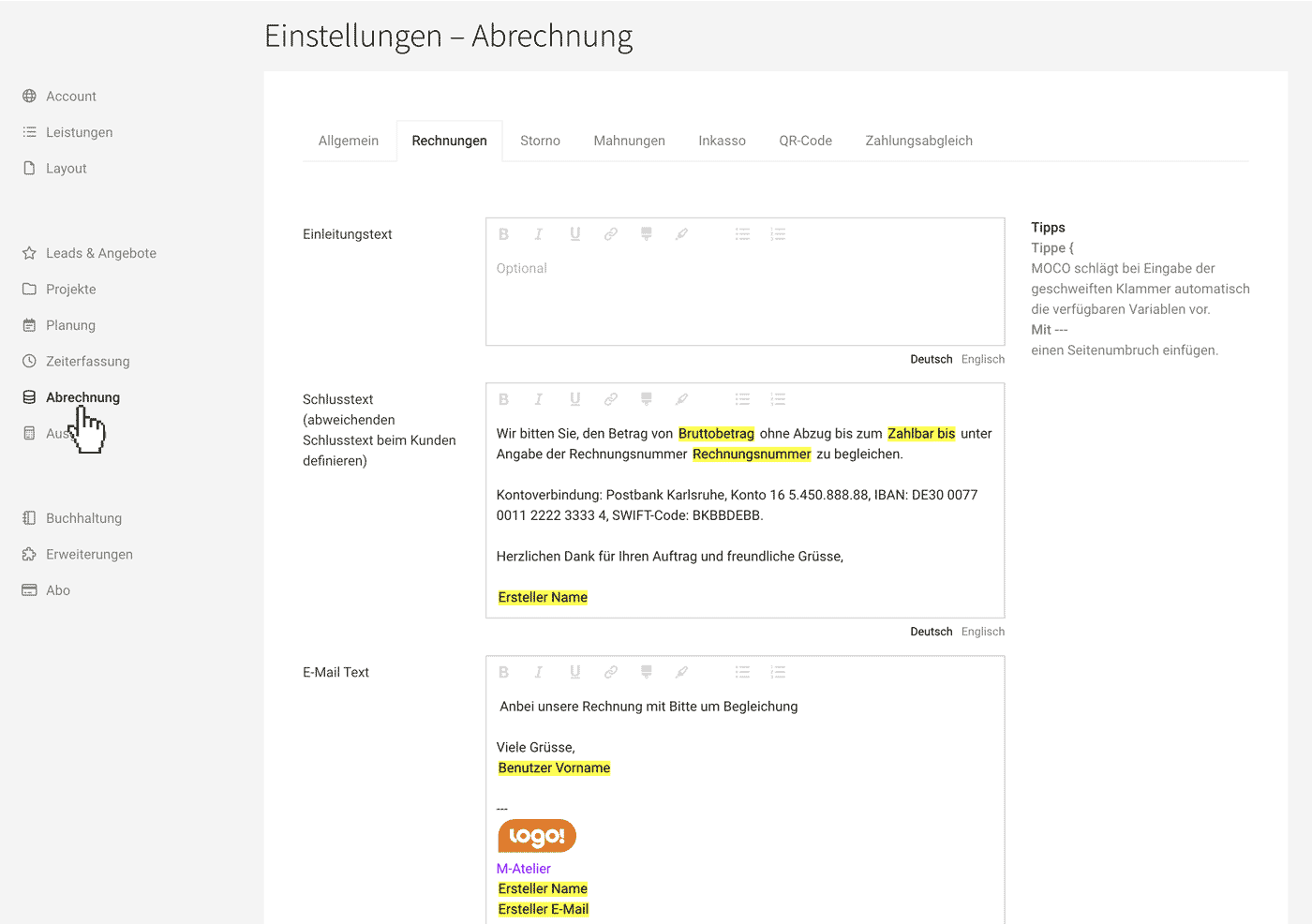

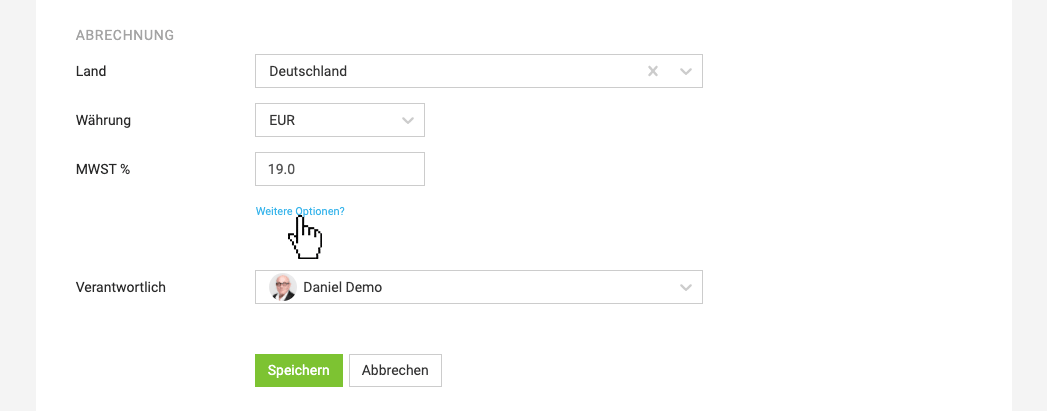

Introduction and Closing Text, Email Text & Signature

Settings > Invoicing > Invoices

English image not yet available...

English image not yet available...

English image not yet available...

English image not yet available...Tip: Leave the introduction text empty If you send invoices via email, there is no need for an introduction text. It only makes the invoice unnecessarily long and adds little value. It is better to include a "Thank you for the order" in the closing text after the payment instructions.

Insert variables

Variables are available. You can call them with "{" (Type alt + "("). (see Note 1)

The salutation line uses fallbacks if it has not been set individually for the contact.

Insert logo for email signature

A previously defined signature image under Account > Email can also be inserted via variables in the email text field.

Insert page break

A page break can be inserted in the introduction and closing text with "---" (see Note 1).

Own UID

It is best to place your own UID or VAT number in the sender information on the letterhead. Otherwise, include it in the standard closing text.

English

The predefined English texts here will be filled in if "Correspondence in English" is selected in the customer's form.

Deviating Standards for Customer

Closing text, payment terms, and hourly rates can be overwritten for individual customers

English image not yet available...

English image not yet available...

English image not yet available...

English image not yet available...The standards can still be adjusted on the invoice at any time. You choose the standard tax rate at the account level in the settings under "Accounting"

Info Block

You determine which document information should be displayed on the invoice in the info block in the settings under Layout > Proposals & Invoices. Alternatively, you can also set info as variables in the text (Type "{" to insert).

Cancellation

Settings > Invoicing > Cancellation

Here you enter the standard texts for cancellation invoices or invoice corrections.

More on cancellation invoice, invoice correction vs. credits

Here you enter the standard texts for cancellation invoices or invoice corrections.

More on cancellation invoice, invoice correction vs. credits

English image not yet available...

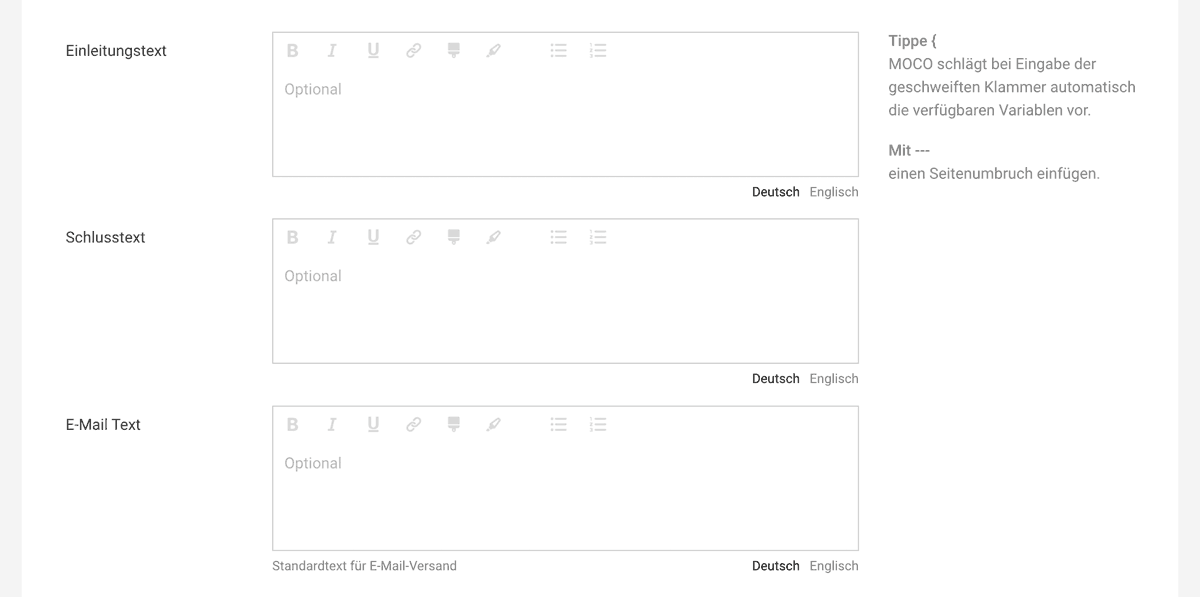

English image not yet available...Reminders

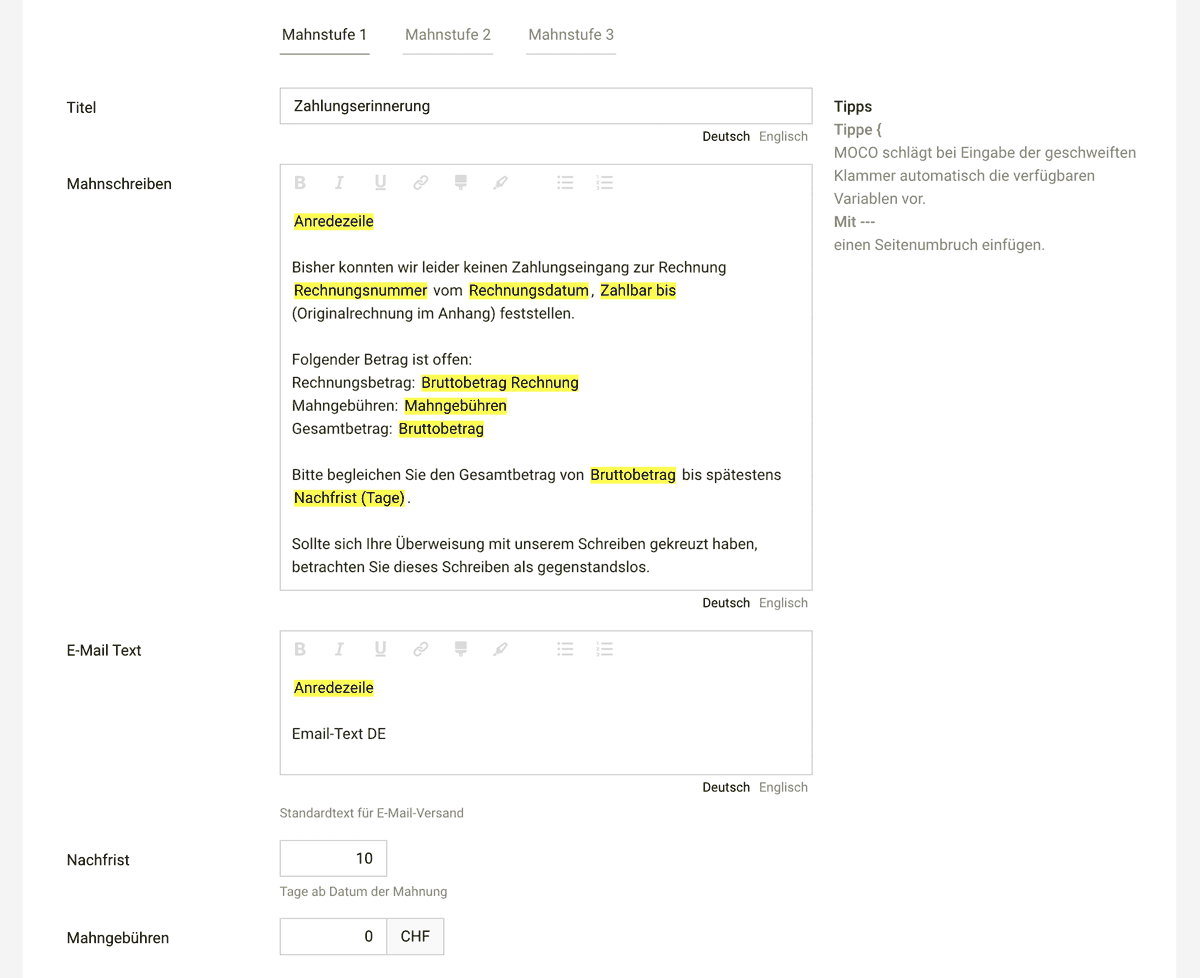

Settings > Invoicing > Reminders

Here you can predefine the texts for your reminder levels. These are mandatory, as MOCO automatically fills in the next level whenever creating a reminder.

English image not yet available...

English image not yet available...

Create reminders individually or all at once with one click

Here you can predefine the texts for your reminder levels. These are mandatory, as MOCO automatically fills in the next level whenever creating a reminder.

English image not yet available...

English image not yet available...Create reminders individually or all at once with one click

QR Invoice (CH) / QR Code

Settings > Invoicing > QR Invoice & eBill

Scan Instead of Typing: A QR code on the invoice makes it easier for recipients to pay their invoices. The client scans the QR code with their banking app, enabling quick, secure, and error-free payments without manual entry.

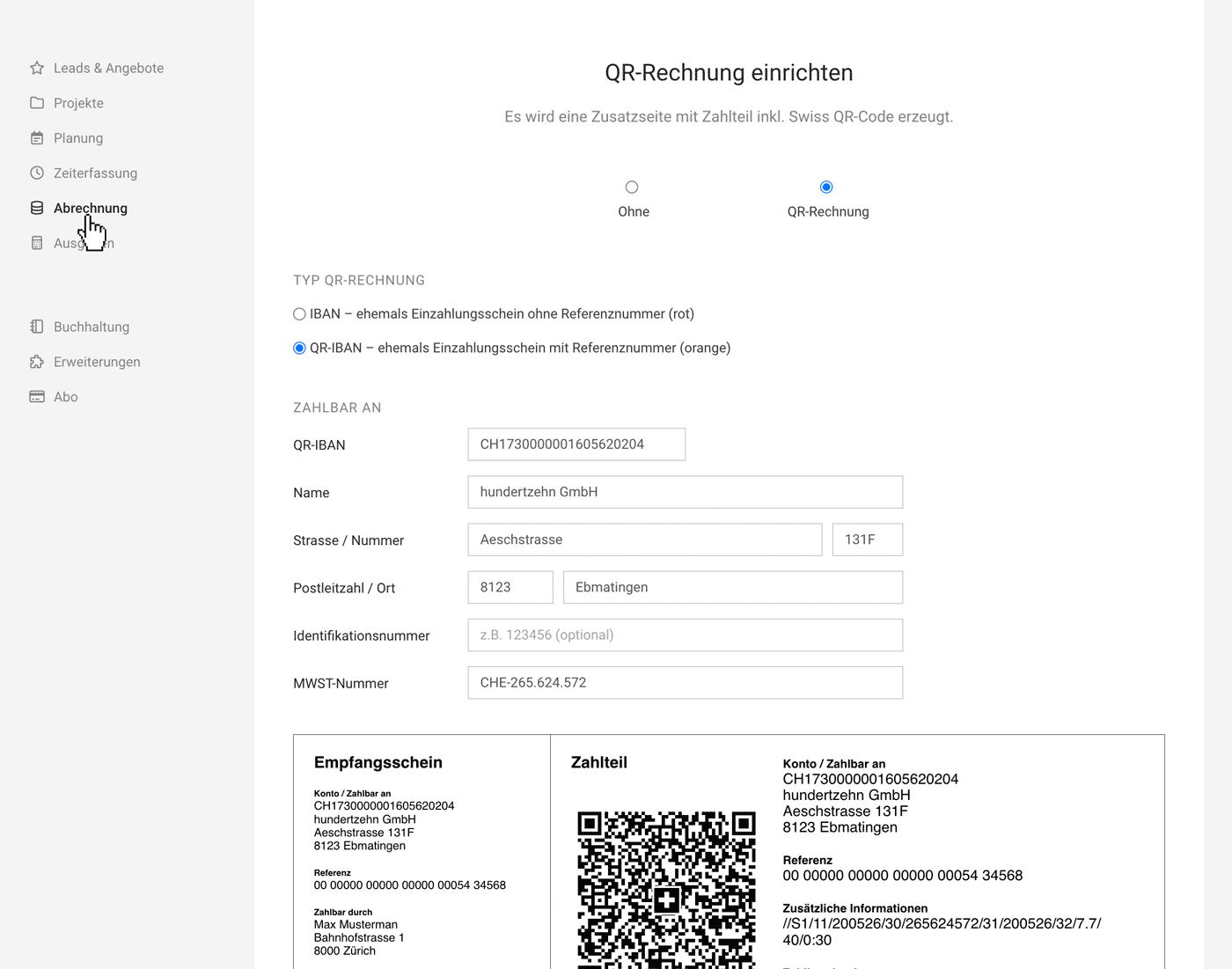

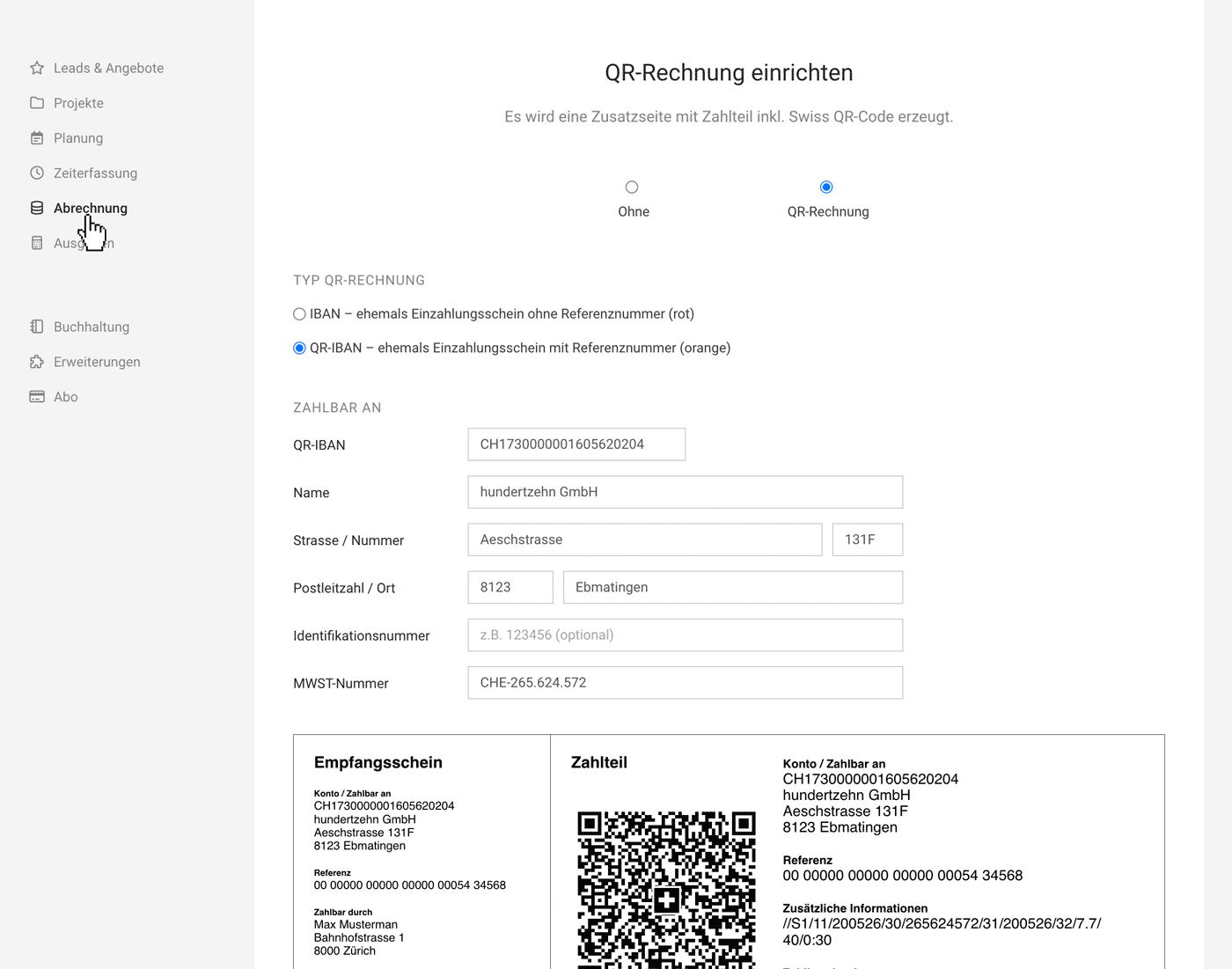

QR Invoice Switzerland

The QR invoice has replaced the previous orange and red payment slips as the standard since October 2022. There are two types of QR invoices:

The QR invoice with QR-IBAN replaces the previous orange payment slip. The QR reference corresponds to the previous ESR reference and facilitates easy reconciliation of invoices with incoming payments. The so-called QR-IBAN replaces the previous 9-digit ESR participant number. This means that instead of the previous 01-..., an IBAN number is now displayed on the payment section with a QR code. This QR-IBAN is assigned by the bank and must be entered in MOCO when setting up the QR invoice.

The QR invoice with a standard IBAN covers simple invoicing – formerly the red payment slip: The reference is not structured.

The QR invoice with a standard IBAN covers simple invoicing – formerly the red payment slip: The reference is not structured.

Setting Up QR Invoice

1. In the settings under "Invoicing" > "ESR/QR Invoice" select the type of QR invoice.

2. Contact your bank to order a QR-IBAN (formerly orange payment slip).

3. Enter the QR-IBAN or IBAN and all other required information.

Below, you will see a preview of the QR payment slip section (4), which will then be automatically added to each invoice.

English image not yet available...

English image not yet available...

The following requirements must be met for an invoice to generate a QR invoice:

Below, you will see a preview of the QR payment slip section (4), which will then be automatically added to each invoice.

English image not yet available...

English image not yet available...The following requirements must be met for an invoice to generate a QR invoice:

- Recipient address complete and correct

- Currency CHF

- Recipient in CH or LI

- Invoice is not a draft

Automatic payment reconciliation via reference number is possible with a camt file!

Further information: Cross-border invoices & QR code

Further information: Cross-border invoices & QR code

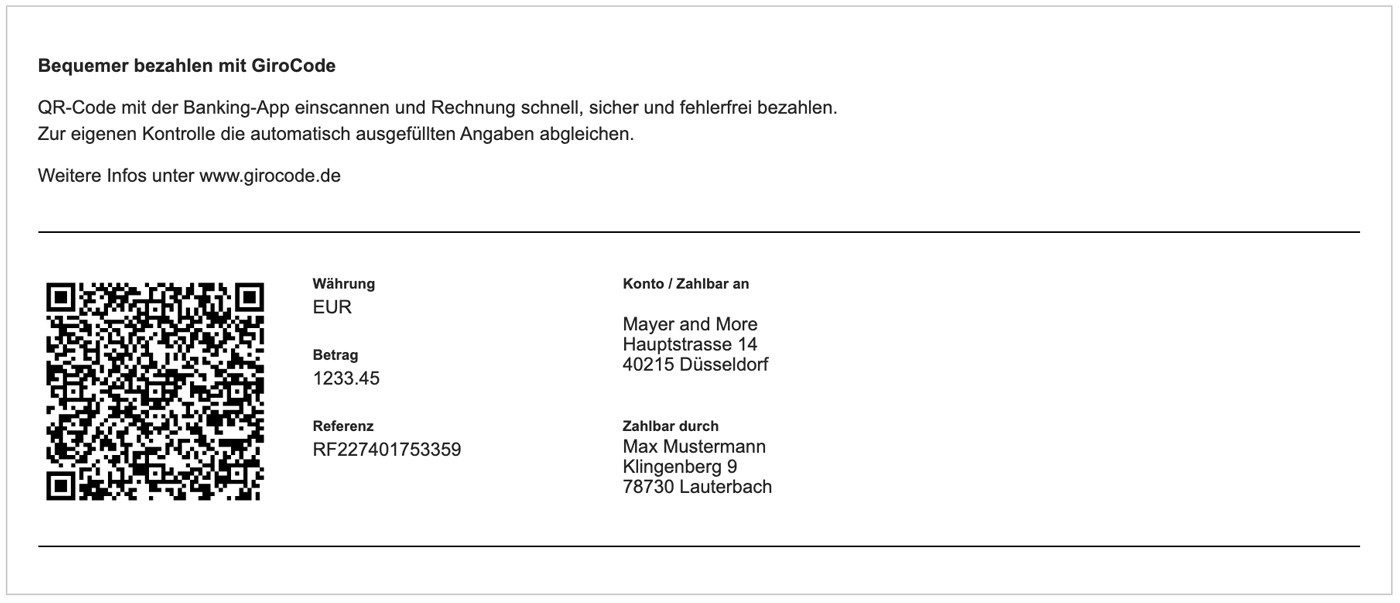

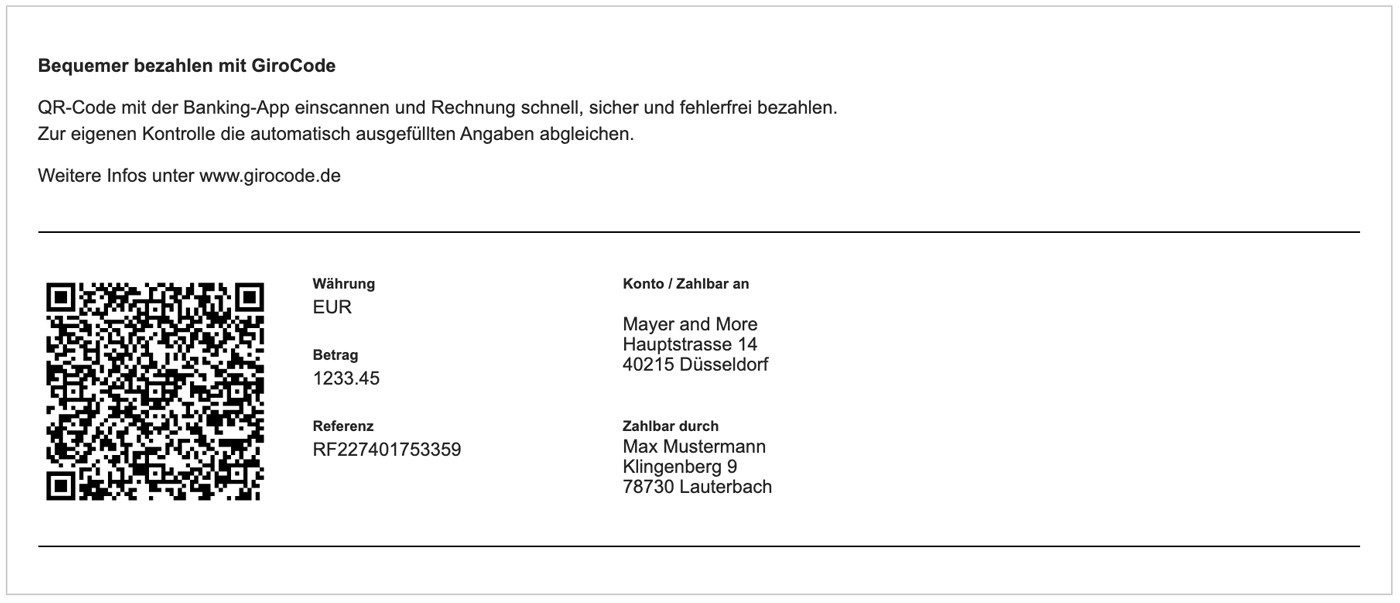

EPC QR Code (GiroCode) International

All other accounts outside Switzerland can create their invoices with the EPC QR code (GiroCode). » All information about GiroCode

English image not yet available...

English image not yet available...

Overview of Benefits

English image not yet available...

English image not yet available...Overview of Benefits

- Simplicity and convenience encourage invoice recipients to pay immediately via mobile banking and at self-service terminals of banks and savings banks.

- Error-free and complete transfer of invoice data.

- Usable for both digital and paper invoices.

How do I activate the GiroCode?

In the MOCO settings under "Invoicing" > "QR Code" activate the option and fill in the transfer details.

In the MOCO settings under "Invoicing" > "QR Code" activate the option and fill in the transfer details.

Miscellaneous

Can the reference number contain the invoice number?

The reference number uses the invoice number without letters and special characters: "RF"+ check digit + invoice number (example: RF35220601). Please notify via in-app service if you still have the previous version ("RF"+ check digit + invoice ID – example: RF3567554) set up and you want to switch.

Search by reference number:

You can search for the reference number in MOCO (global search and through the "Search term" field in the invoice list filter).

The reference number uses the invoice number without letters and special characters: "RF"+ check digit + invoice number (example: RF35220601). Please notify via in-app service if you still have the previous version ("RF"+ check digit + invoice ID – example: RF3567554) set up and you want to switch.

Search by reference number:

You can search for the reference number in MOCO (global search and through the "Search term" field in the invoice list filter).

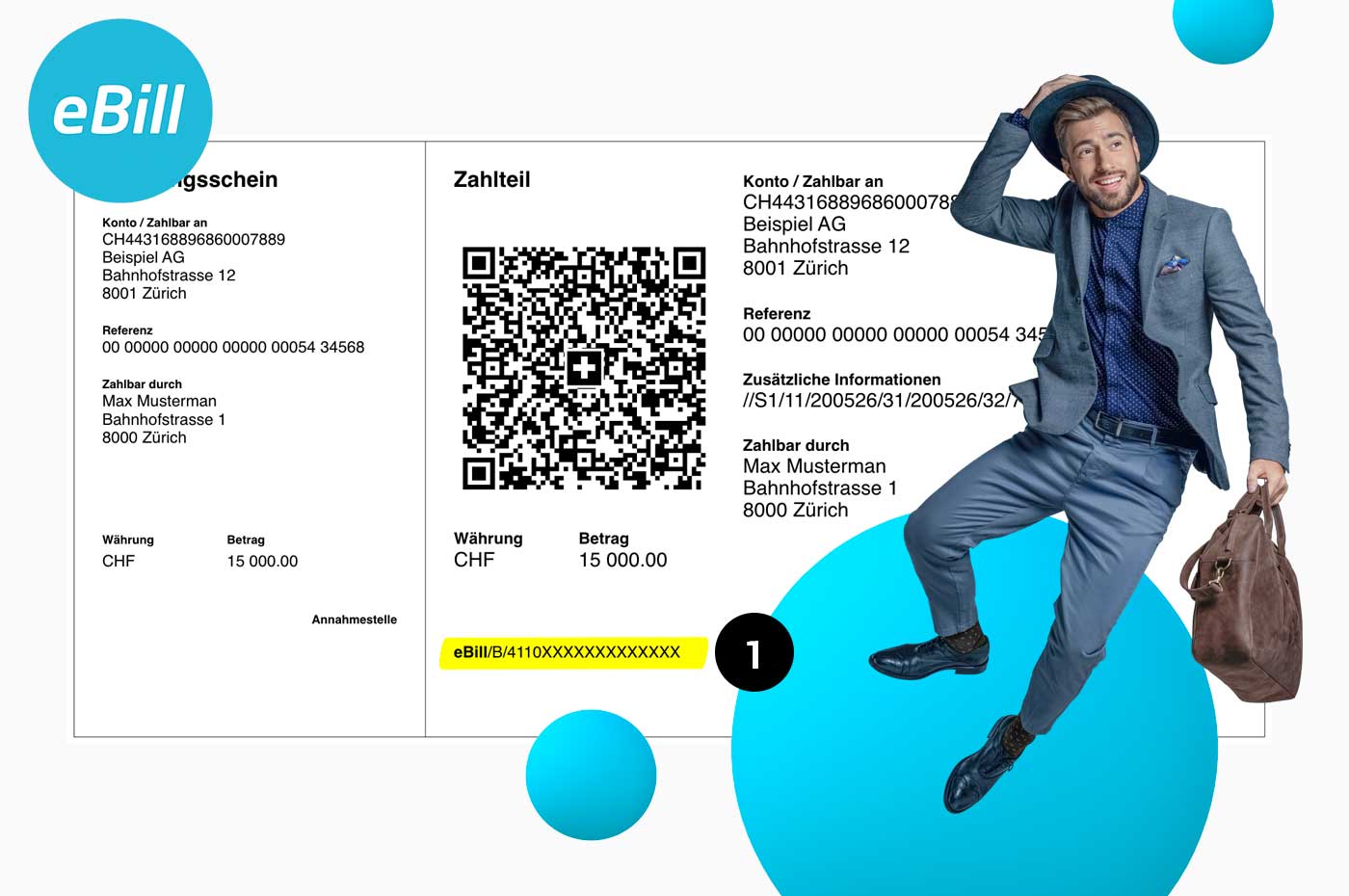

eBill (CH)

Settings > Invoicing > QR-Invoice & eBill

eBill is a payment method for invoices in Switzerland. With eBill, your customers no longer receive their invoices by mail or email, but directly in their e-banking. There, they can review them with just a few clicks and pay directly.

Advantages of eBill

- Each customer decides for themselves in e-banking whether they want to pay your invoices using the eBill procedure. Others simply see an additional note on their payment slip (see Figure 1).

English image not yet available...

English image not yet available...- Payments can be transmitted quickly, without errors, and reliably.

- Your customer perceives the invoice as secure and trustworthy.

- You are perceived as progressive by your customer when you offer a modern payment option.

- Less paper consumption due to the digital invoicing process (if you previously sent by mail).

More information on activating and using the eBill payment method for your QR-invoices.

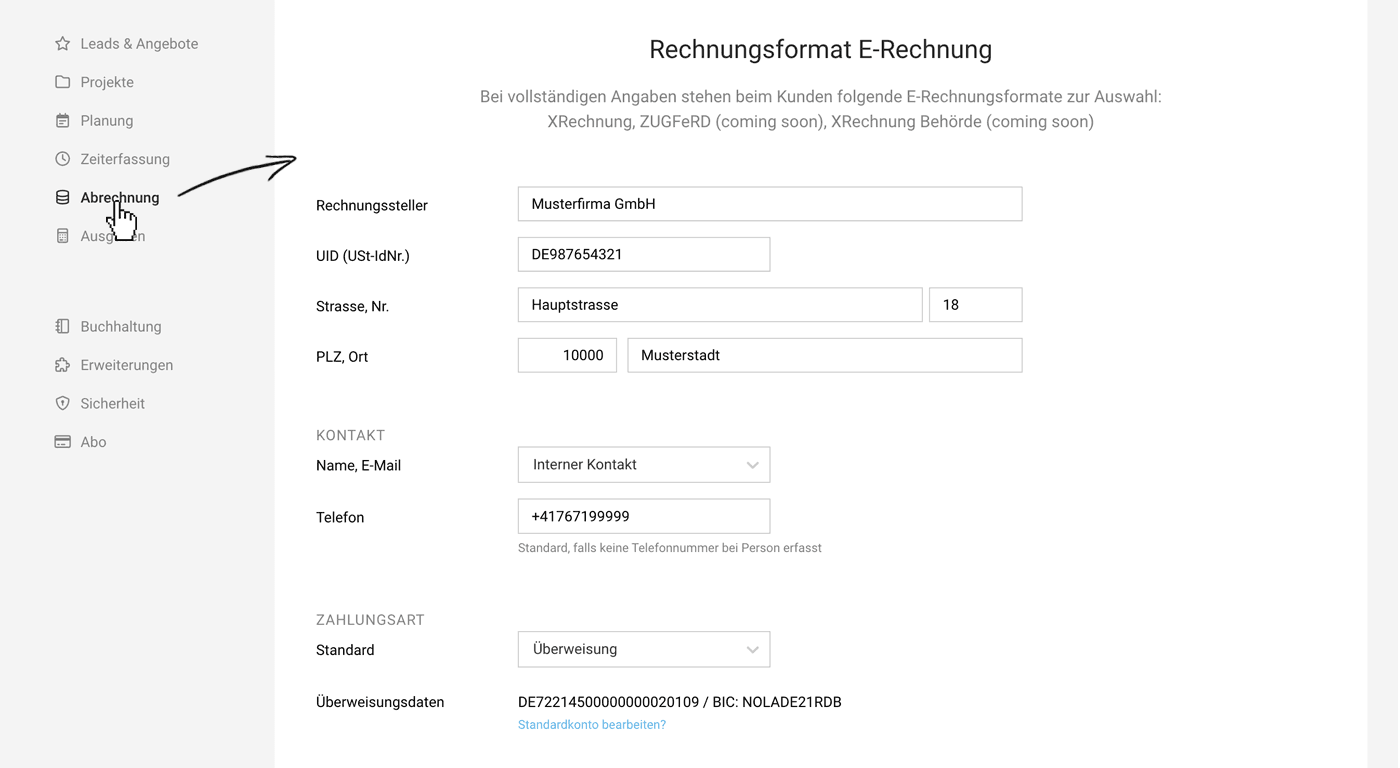

E-Invoices

Settings > Invoicing > E-Invoices

The EU plans to implement E-Invoices widely. As of January 1, 2025, companies in Germany are required to be able to receive E-Invoices. With MOCO, you can meet this requirement: MOCO can capture and process E-Invoices (via email or upload). All information including video For the creation of E-Invoices, there are generous transition periods (until the end of 2026).

Activate E-Invoice Creation in MOCO

English image not yet available...

English image not yet available...Verify Sender Information

Your sender details as the invoice issuer (seller) – including contact information – must be complete and accurate.

Your sender details as the invoice issuer (seller) – including contact information – must be complete and accurate.

Set Default Payment Method

Decide which payment method should be used by default. This standard is automatically applied to all clients for whom you select an E-Invoice format (can be adjusted if needed). You can also change the payment method directly on the invoice.

- Bank Transfer:

Choose this option if you want to send your bank details with the E-Invoice – this is usually the appropriate choice for project business. - Neutral:

Select “Neutral” if your clients use different payment methods, such as direct debit. In this case, MOCO does not send bank details with the E-Invoice. You can include payment method notes in the closing text – this is also transmitted with the XInvoice.

After saving the complete information, you can select the E-Invoice format for the client

MOCO will automatically check if the billing address meets the requirements of the chosen format. If the address is not recognized as “structured,” you will need to adjust it accordingly.

MOCO will automatically check if the billing address meets the requirements of the chosen format. If the address is not recognized as “structured,” you will need to adjust it accordingly.

Applies Only to New Invoices

The chosen setting applies to all newly created invoices for this client. Existing invoices in PDF format remain unchanged – they are not automatically converted to another format.

Not Subject to VAT

If you fall under the small business regulation, you do not need to show VAT on the invoice. A corresponding note informs the recipient of the invoice about this particularity.

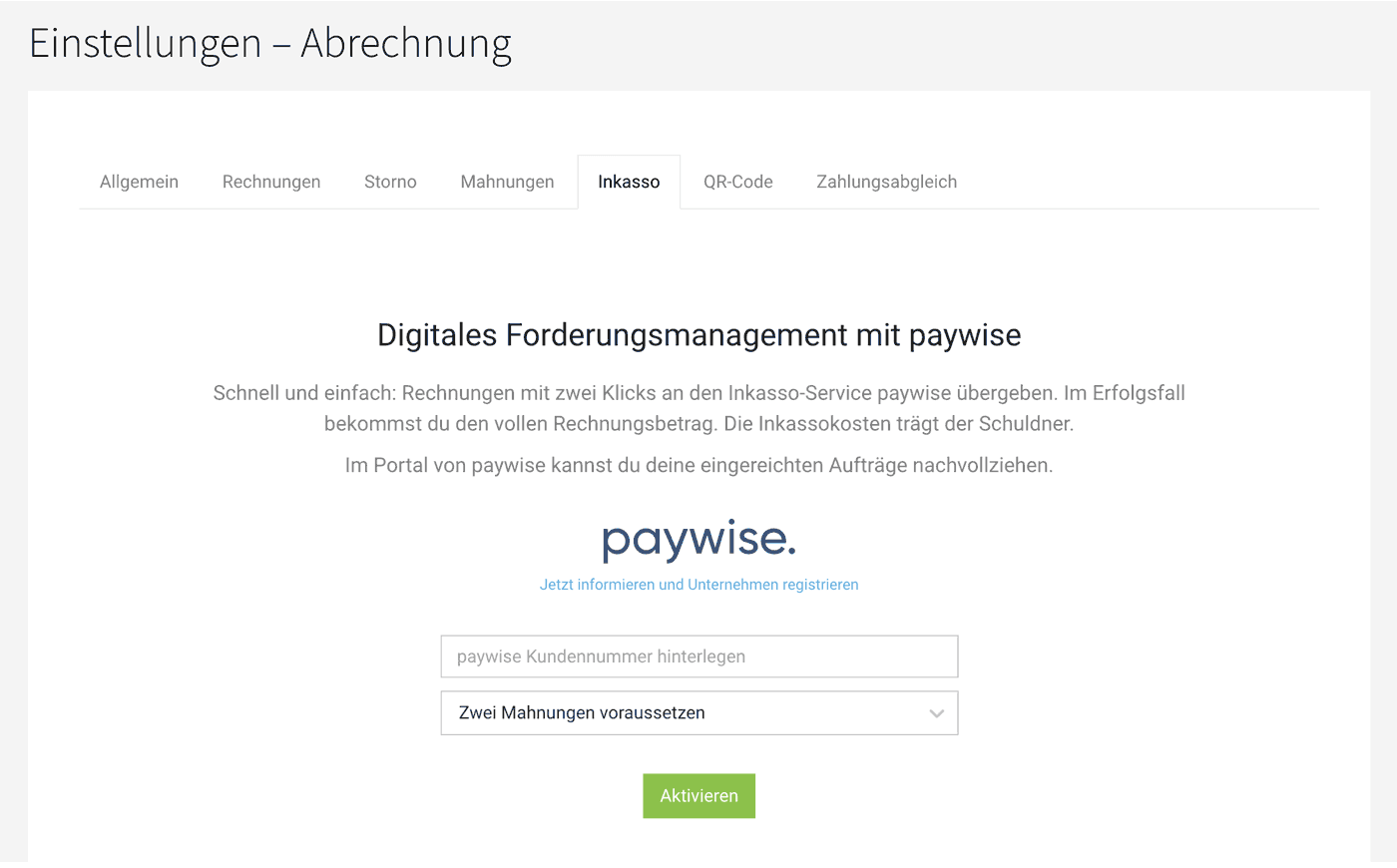

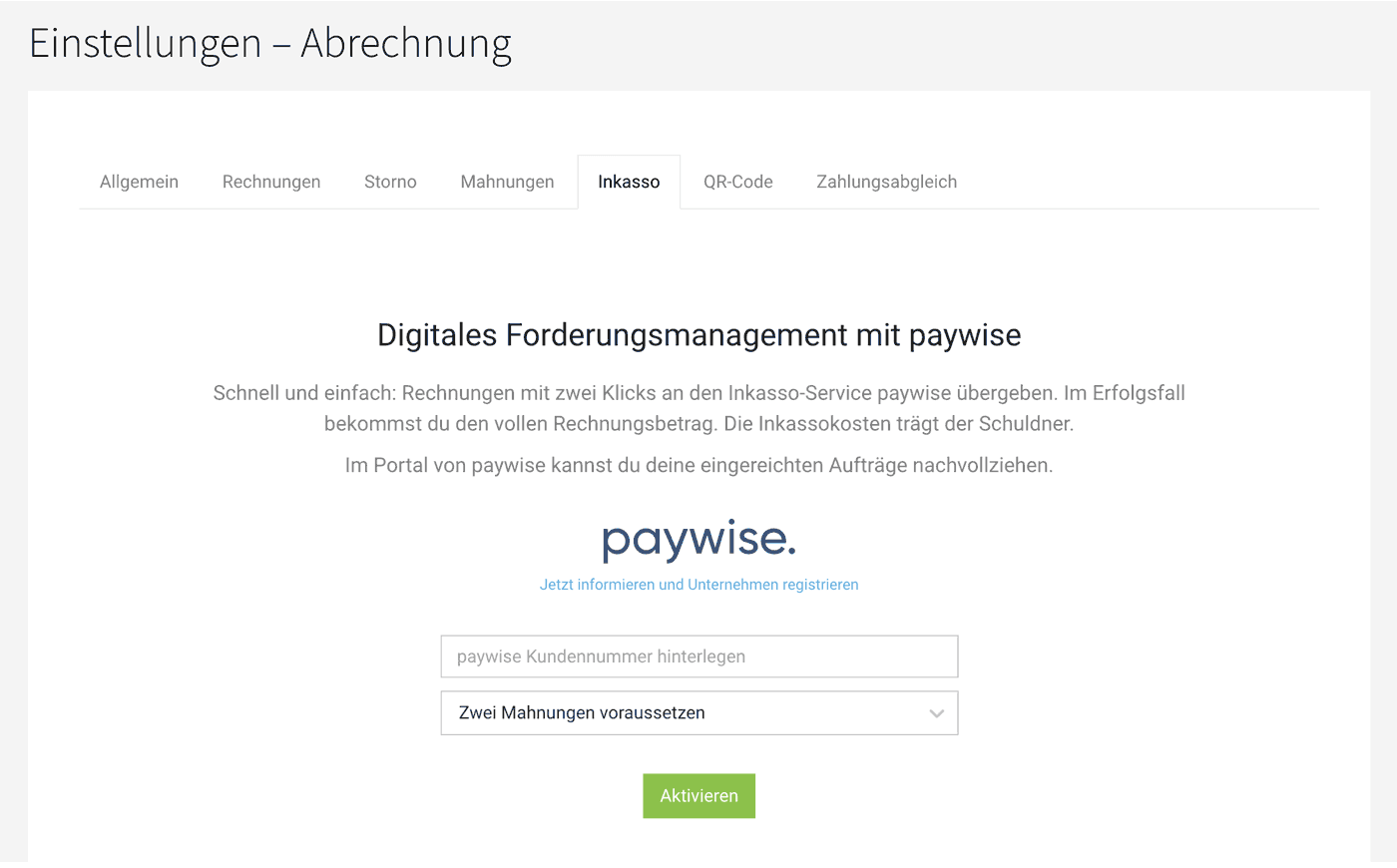

Debt Collection

Settings > Invoicing > Debt Collection

English image not yet available...

English image not yet available...

English image not yet available...

English image not yet available...Ordered, delivered – but your client isn't paying the invoice? With just two clicks, an invoice can be handed over to the debt collection service.

Free Service

The service is free for you as a MOCO user. The debtor bears the collection fees. This service is offered in collaboration with the debt collection company paywise.

Activation

Once you have activated the debt collection option, you can use the "Debt Collection" button at the top right of the invoice! You will need a paywise client number for activation. Register for an account with paywise beforehand. Registration is completed in just a few minutes.

Register directly with paywise

Register directly with paywise

Submit Invoice

1. Click the orange "Debt Collection" button on the invoice.

2. Add any information about the previous process and confirm the order.

3. The invoice, including relevant information, is transferred to paywise.

4. You will receive an acknowledgment email from paywise within minutes.

In your paywise account, you can track all orders.

More about the functionality

2. Add any information about the previous process and confirm the order.

3. The invoice, including relevant information, is transferred to paywise.

4. You will receive an acknowledgment email from paywise within minutes.

In your paywise account, you can track all orders.

More about the functionality

Terms and Conditions

- Debtor and/or creditor must be located in Germany

- Payment deadline of the invoice (or last reminder) has passed

- Invoice not expired (3 years)

- Communication exclusively in German

- Legal proceedings exclusively in Germany

What does free really mean?

Paywise does not charge membership or enrollment fees and does not require a subscription.

You incur no direct costs for the debt collection service. If your debtor pays the invoice amount, you receive 100% of the invoice amount. Your debtor must pay a collection fee in addition to the invoice amount (amounts are regulated by law).

If the debtor is insolvent, you do not have to pay any fees to Paywise.

If paywise is unsuccessful out of court, the legal dunning process is initiated. To avoid unnecessary costs, paywise obtains a SCHUFA report beforehand and proceeds only if there are no negative entries or if you wish. Since the court charges fees for the process, you must pay these as an advance. For claims under 1,000 euros, it is 36 euros. Bailiffs and the enforcement court also charge fees, usually between 40 and 120 euros per measure, which paywise also bills as an advance. These advances are reclaimed from the debtor by paywise, but there is a risk if the debtor is insolvent.

Detailed information on paywise

You incur no direct costs for the debt collection service. If your debtor pays the invoice amount, you receive 100% of the invoice amount. Your debtor must pay a collection fee in addition to the invoice amount (amounts are regulated by law).

If the debtor is insolvent, you do not have to pay any fees to Paywise.

If paywise is unsuccessful out of court, the legal dunning process is initiated. To avoid unnecessary costs, paywise obtains a SCHUFA report beforehand and proceeds only if there are no negative entries or if you wish. Since the court charges fees for the process, you must pay these as an advance. For claims under 1,000 euros, it is 36 euros. Bailiffs and the enforcement court also charge fees, usually between 40 and 120 euros per measure, which paywise also bills as an advance. These advances are reclaimed from the debtor by paywise, but there is a risk if the debtor is insolvent.

Detailed information on paywise